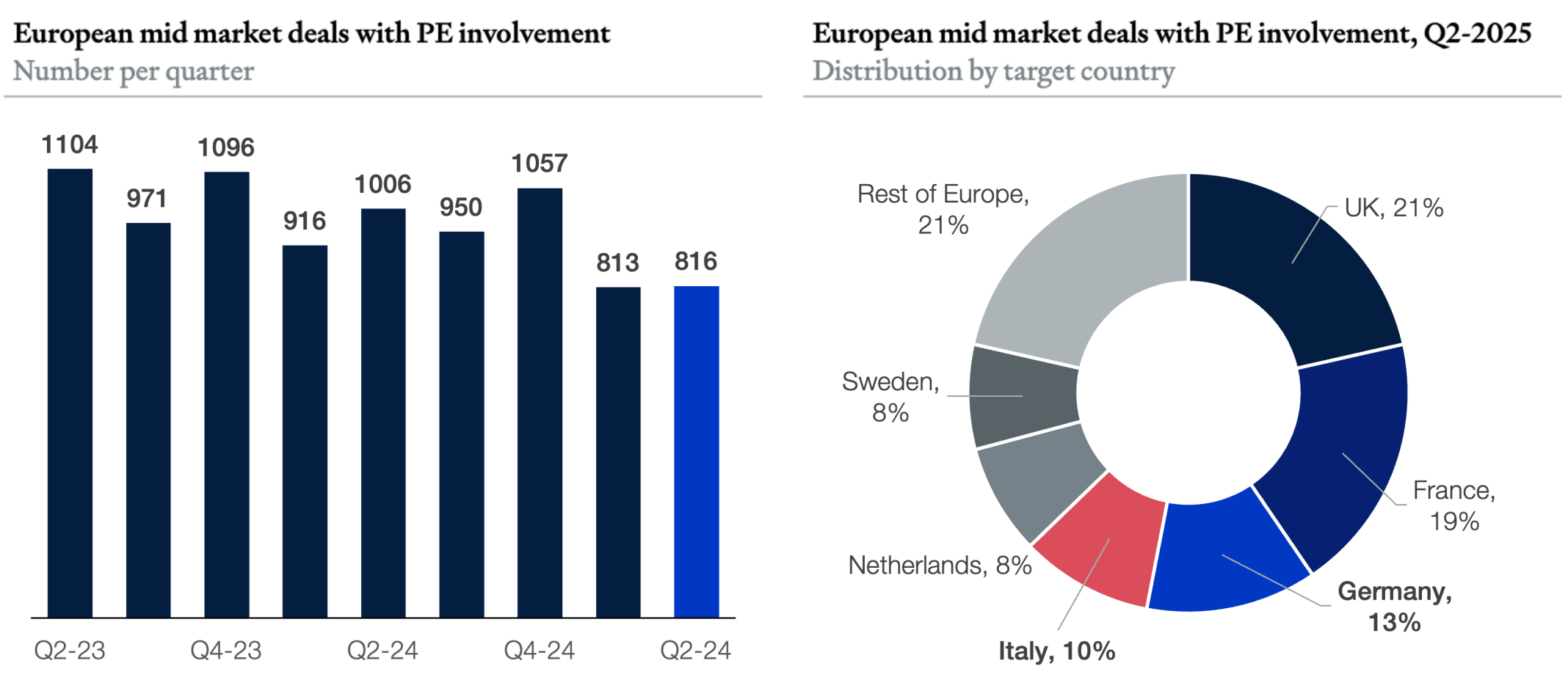

European midmarket Q2-2015

With all that is going on, in particular the havoc brought on by the new US administration in terms of trade and geopolitics, European midmarket PE transactions fared remarkably well. Still, volumes in the two first quarters are ±20% below 2023/24 levels and the deal surge many expected last year for 2025 could not materialize.

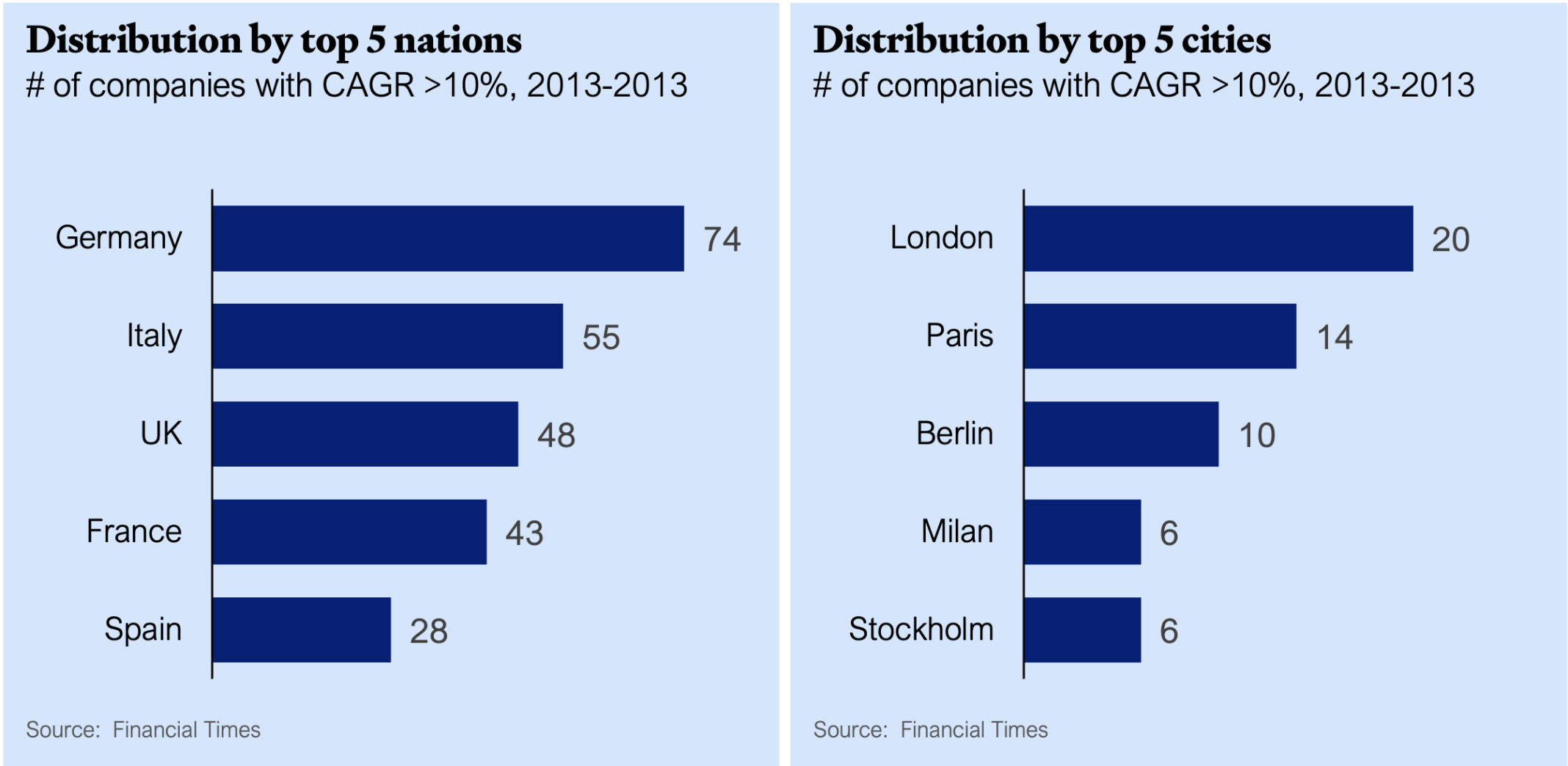

As to be expected, France and UK, the markets with the most established and international private equity landscapes, dominate. A clear positive is the strong weight Germany and Italy achieve despite their respective economic struggles and the doom-narrative, which is so wide spread in both countries.

Solidity and secular trends

So much for descriptive statistics: Things are not as bad as feared. A more interesting question is what type of assets were bought.

An old favorite, B2B services emerges as the clear winning theme in Q2-2025, capturing over 25% of European mid-market deal flow, with particularly strong activity in the UK and France. The appeal is straightforward: these businesses typically enjoy defensible market positions within specialized niches, benefit from established client relationships, and often generate recurring revenue streams while delivering mission-critical services. Recent examples illustrate the margin profile that attracts investors – Italian gas station services provider Fortech (Perwyn's acquisition) and Italian mid-market accounting firm Bishop Fleming (Synova's target) both demonstrate EBITDA margins in the 30-40% range.

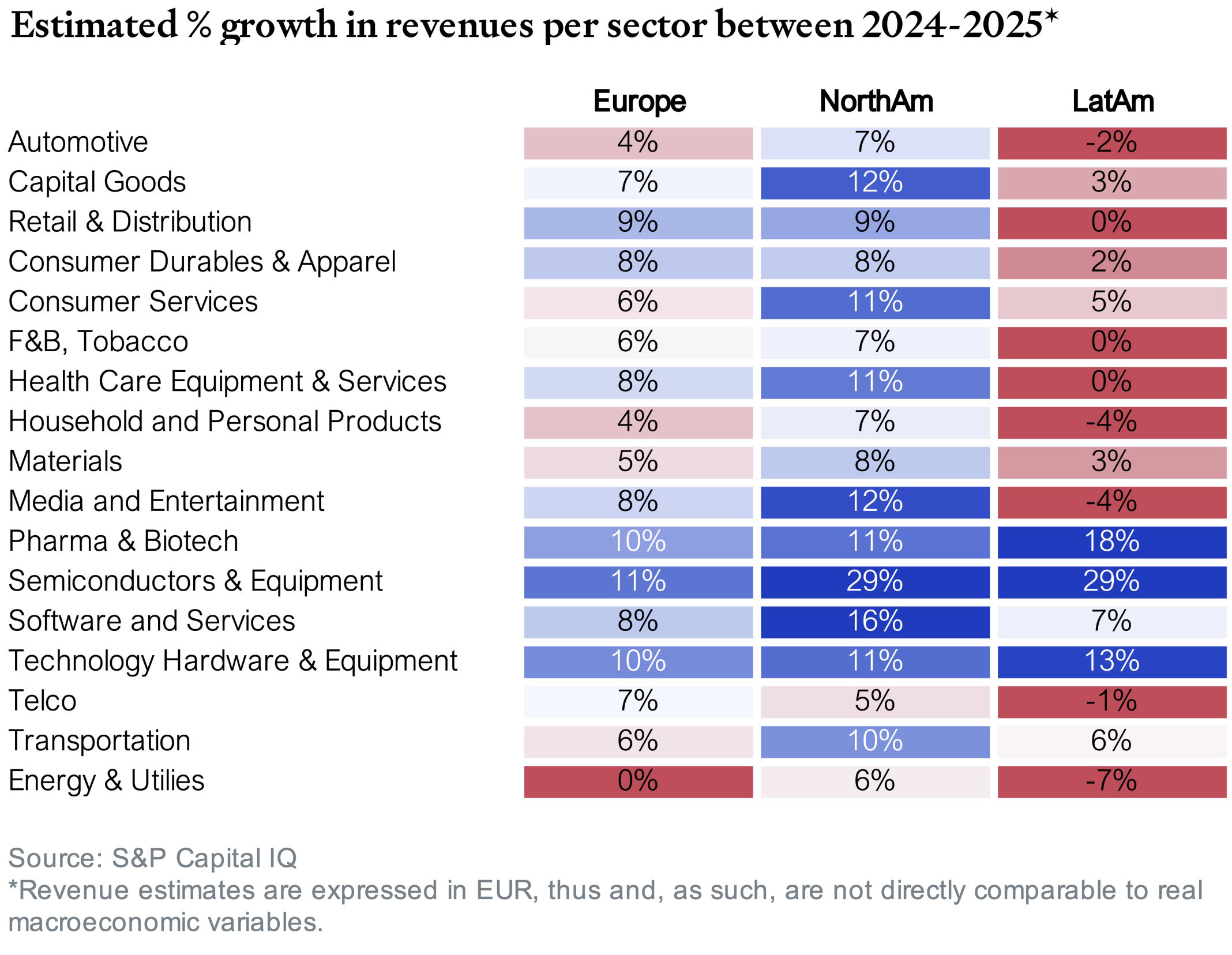

Manufacturing holds the second position in deal volume, though this category encompasses markedly different investment approaches. Some transactions clearly capitalize on secular tailwinds – defense contractors like Iveco Defense benefit from increased European defense spending, while electrification plays such as Elektromontaż Lublin align with the green transition. Other deals appear more opportunistic, targeting undervalued manufacturing excellence like Mathevon, alongside a notable cohort of distressed situations and turnaround candidates.

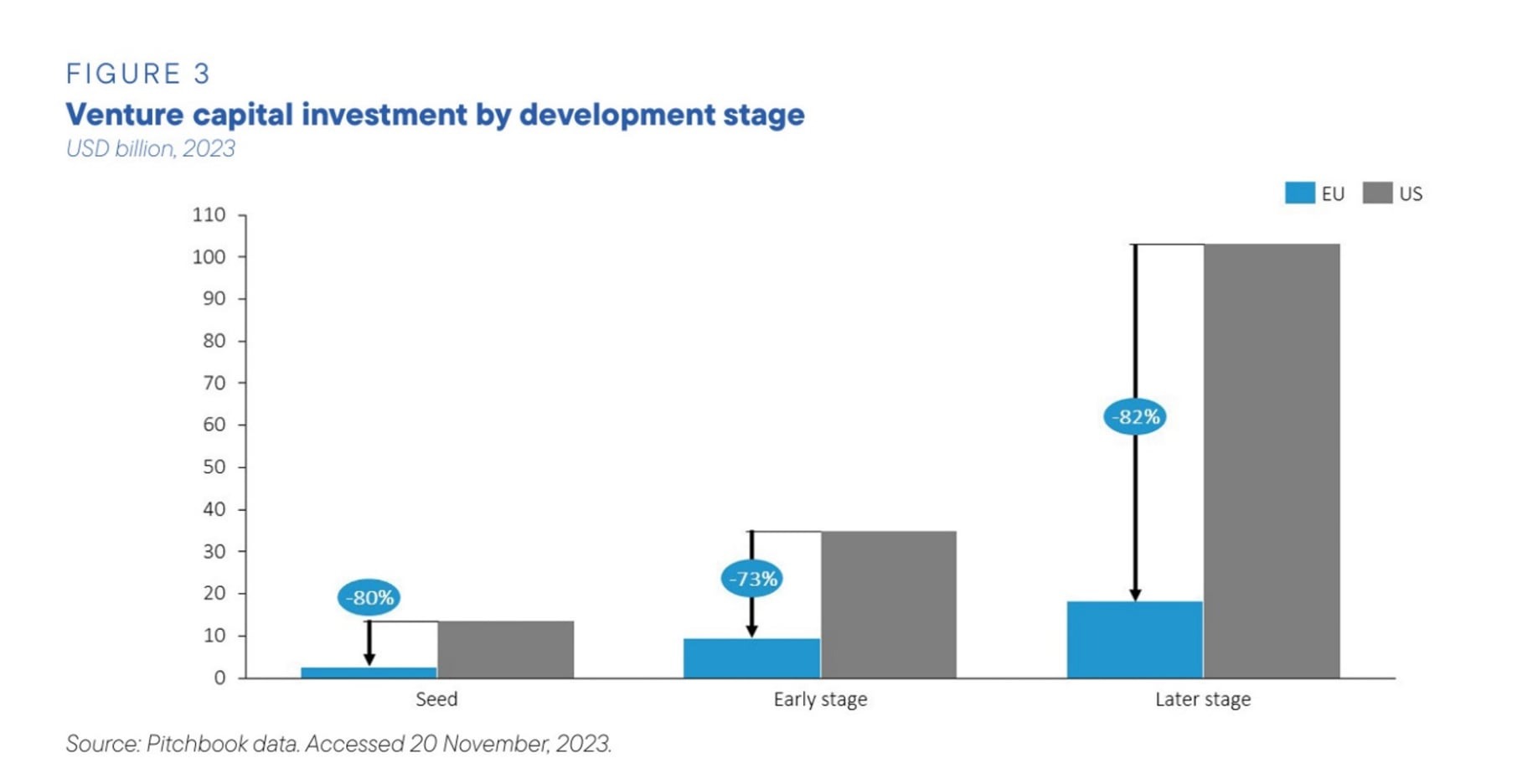

Although it sometimes seems, all investors want low asset intensity 100% recurring revenue growth stories, software and tech only come third in Europe – although that masks a highly uneven distribution: >80% of TMT deals were in UK, France, Germany, and Benelux. The intense investor activities over the last years has pushed consolidation and left few attractive midcap targets. In addition, AI is tilting scales in favor of larger players. It still is an interesting segment if one looks in the right niches, though, and the lack of activity outside core Western Europe potentially indicated untapped potential in other parts of Europe.

While healthcare, pharma, and medtech represent smaller portions of overall European mid-market activity, they dominate in Italy and Germany, albeit with differing investment rationales: Germany's medtech deals capitalize on innovation-driven growth within a robust regulatory environment that's actively encouraging digital transformation, while Italy's healthcare and pharma targets represent defensive plays addressing systemic capacity shortfalls. Strategic acquisitions and private equity investments are expected to continue driving consolidation and innovation in the sector in Italy, but the underlying drivers are market necessity rather than technological opportunity, explaining why German deals skew toward advanced medtech while Italian activity concentrates on essential healthcare services and pharmaceutical distribution.

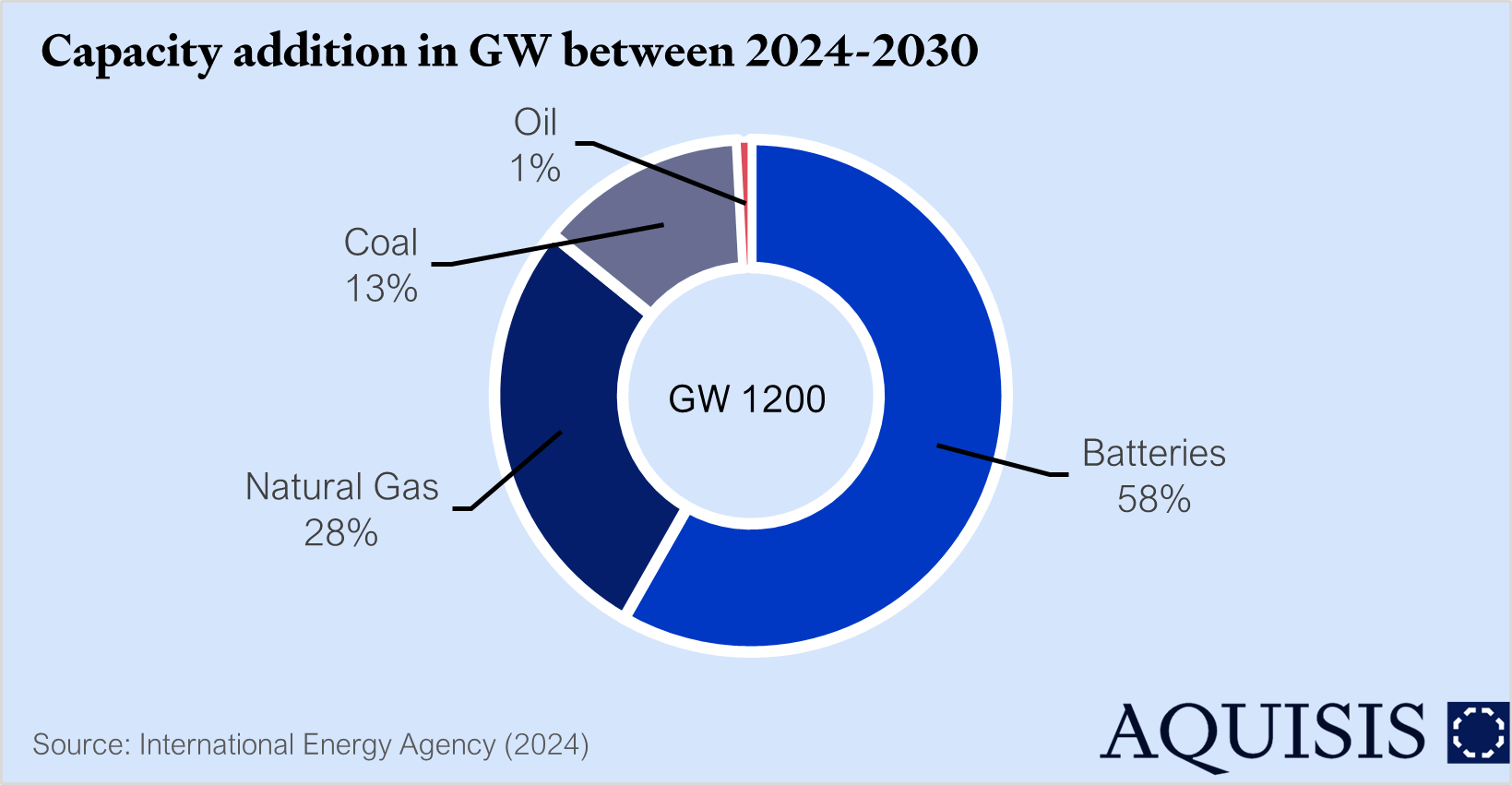

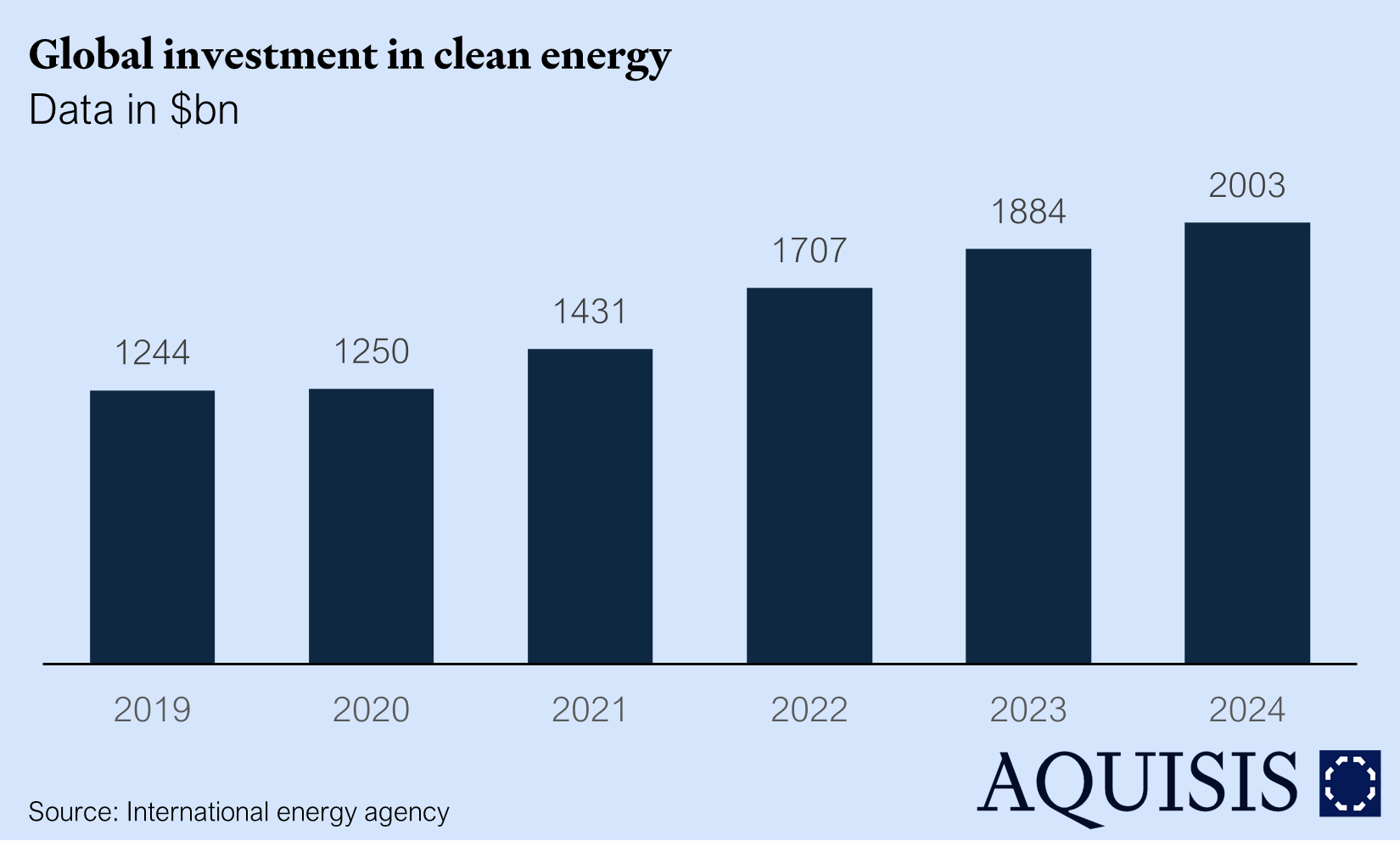

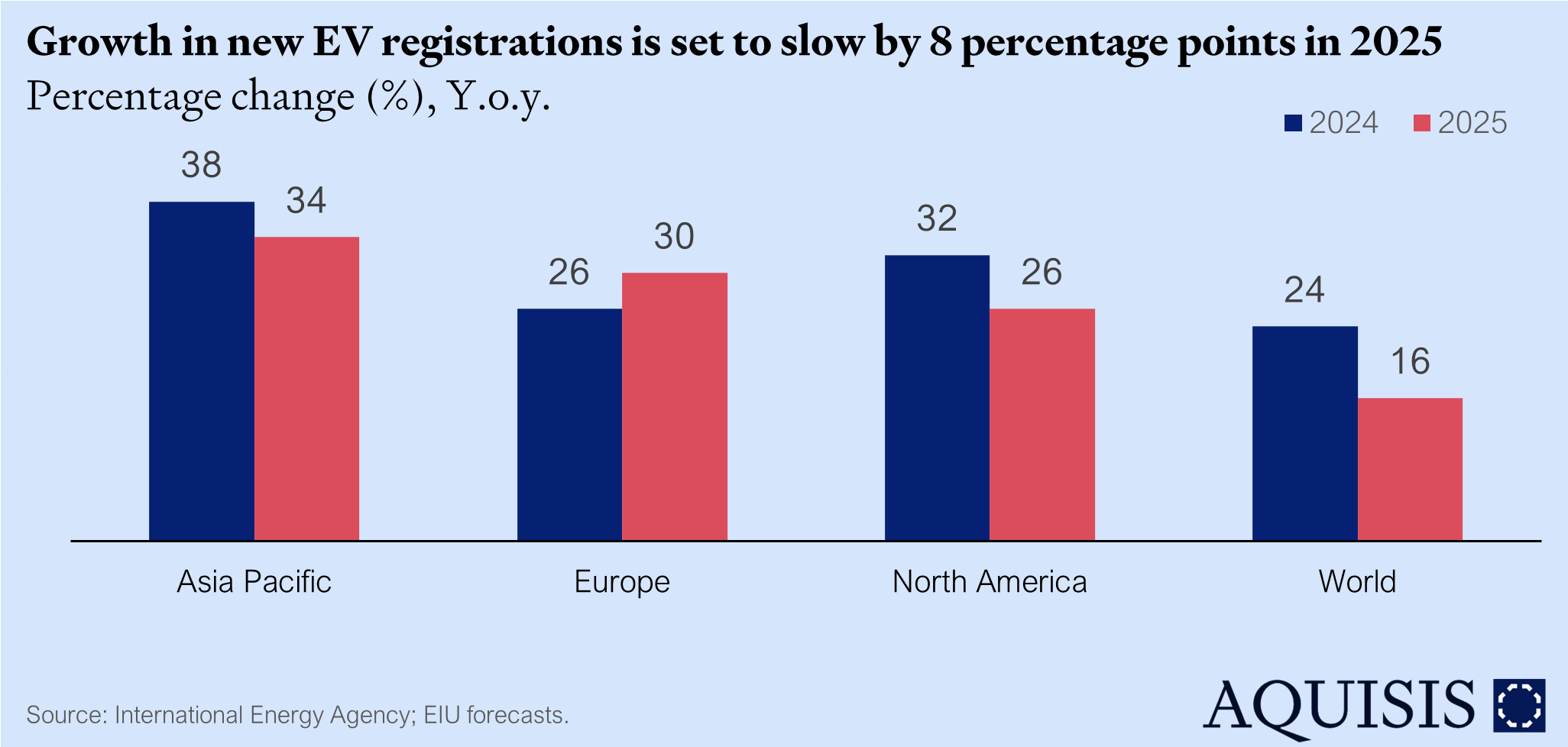

Heartening though almost surprising given the current political cliimate, is the continued strong push of smart money into green energy and electrification. This often veers towards large cap, e.g. Ares paying €2bn for 20% in ENI Plenitude, or Ardian acquiring both French Akuo and 117 solar plants in Italy. But also in the mid market, there are interesting deals along the ‘green’ theme, e.g. UK maker of electrical power generation and distribution equipment BRUSH, or UK provider of Capex-free EV charging infrastructure Believ.

Consumer verticals generally are not a focus at the moment (neither have they historically been for most PEs given the risk profile, with the exception of a few specialist funds). Highly resilient F&B represents the primary exception, particularly in Italy, France, and Germany. Two distinct F&B themes emerge: highly targeted offerings addressing specific consumer segments (health, wellness, sustainability, fair trade) and strong heritage brands like Dallmayr and Cinzano. The latter may benefit from defensive consumption patterns during economic uncertainty – the "lipstick effect" where consumers maintain small indulgences while cutting larger expenditures.

Overall France and Italy make up almost half of European consumer target deals, a testament to the importance of heritage, local supplier ecosystems, and the importance of tacit knowledge.

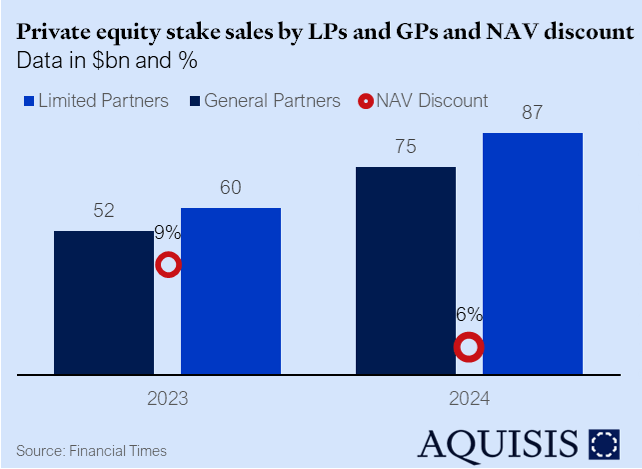

While we focus on midcap, for LargeCap, it's an entirely different market. Here, interesting but capital intensive businesses like MedTech, Insurance, and Energy dominate. Beyond individual deals, cross-reading recent press coverage, major trends continue to be private credit, PE foraying into infra and specialty real estate, as well as continuation funds.