Climate change: A driver of financial risk and higher borrowing costs

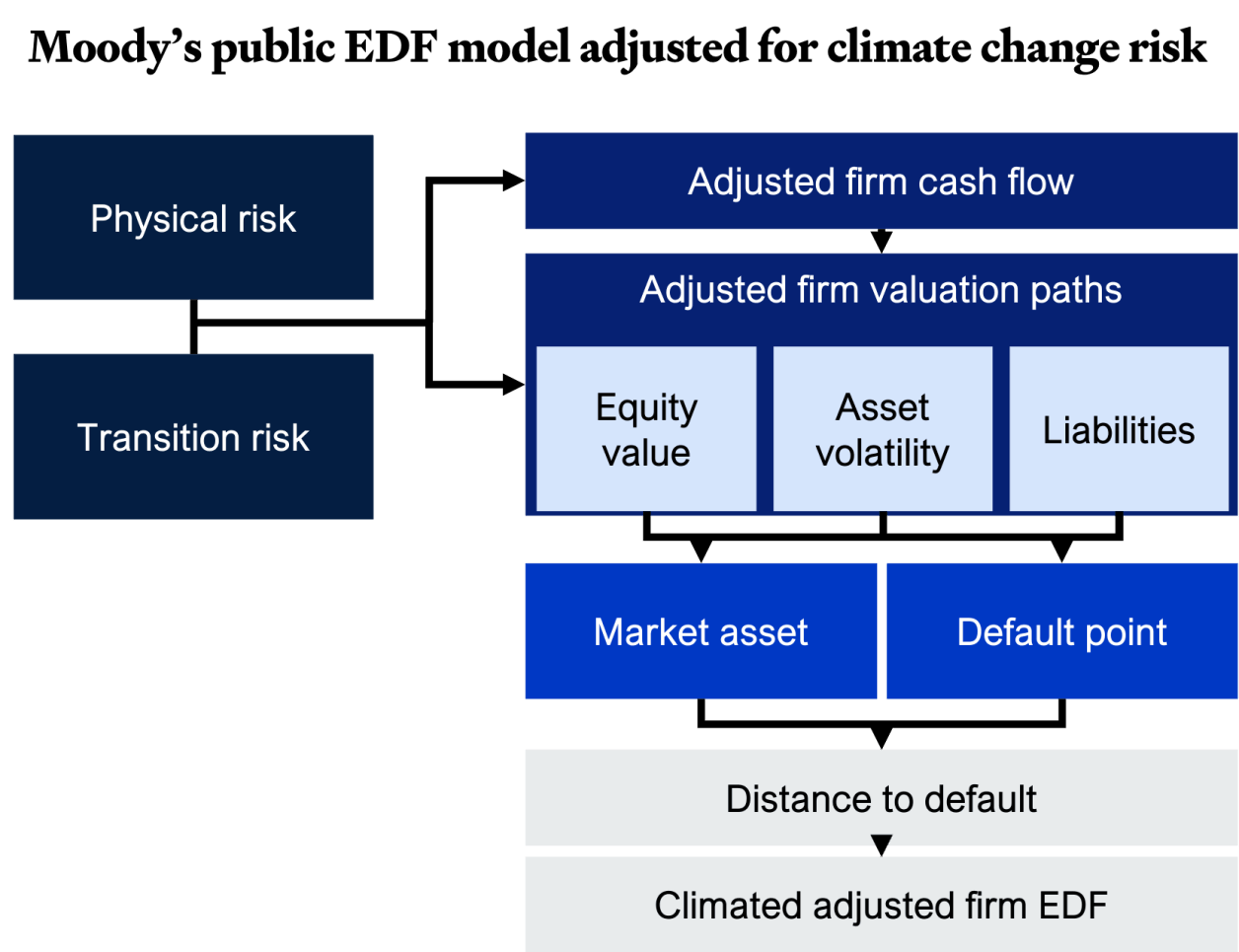

In addition to adding pressure on energy costs, climate change is already considered a megatrend that can have material impacts on the creditworthiness of issuers and debt instruments, and is already identified as one of the key risks to credit conditions. Credit agencies are integrating climate change risk to adjust probability of defaults, Moody’s has developed a climate-adjusted version of its Public Firm Expected Default Frequency model, a structural model of credit risk that is used by global banks, insurers, corporates, and asset managers by more than 30 years (Moody's, 2024).

Moody’s divided climate change risk into two subgroup: physical risk and transition risk. Physical risk encompasses the costs and risks arising from the physical effects of climate change on businesses’ operations, workforce, markets, infrastructure, raw materials, and assets. Transition risk encompasses the costs and risks associated with the transition to a lower carbon economy, including policy changes, new regulations on goods and services, reputational impacts, and shifts in market preferences, norms, and technologies.

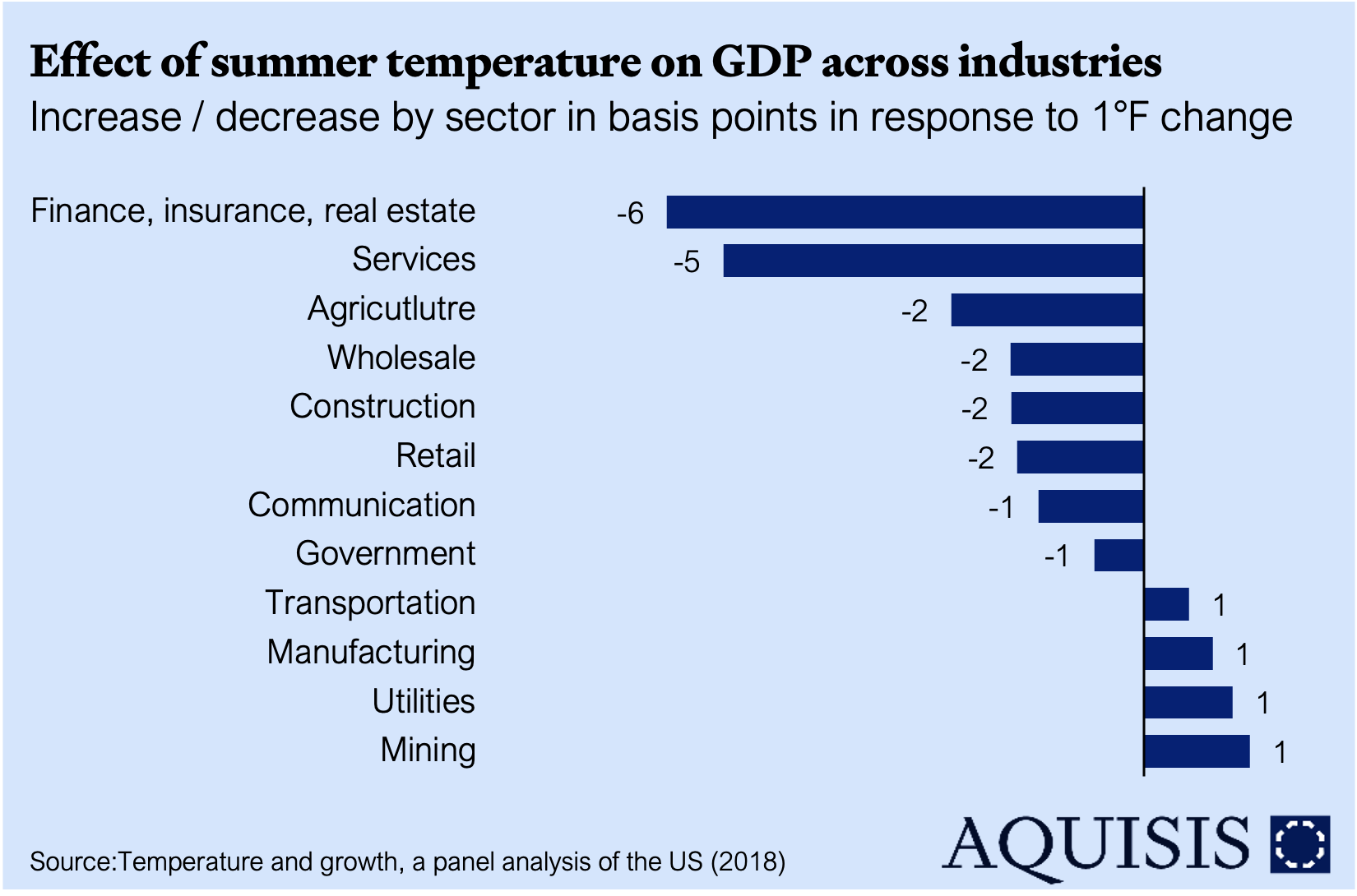

Levels of physical and transition risk can vary dramatically between firms. Firms with facilities in South East Asia, the Middle East, and the Caribbean, areas with high exposures to warming-related climate and weather events, will have relatively high physical risk. Under various climate scenarios, additional global physical damage is projected to be close to 3% of GDP per year by 2050. Firms in industrial sectors such as Coal, Oil & Gas, and Electricity Generation, which are highly exposed to carbon transition, will have relatively high transition risk.

This adds a layer of complexity to industry and company valuations. Consequently, the cost of capital is likely to increase for businesses operating in sectors or regions with heightened exposure to climate change risks or stringent regulations. How can a company mitigate this financial burden? By adopting green practices. In August, the European Central Bank (ECB) highlighted that Eurozone banks are already imposing higher interest rates on “brown” companies compared to their greener counterparts. Research revealed that companies with the highest carbon emissions faced borrowing costs approximately 0.14 percentage points higher than those with the lowest emissions. Furthermore, commitments to reduce emissions already influenced borrowing costs: Companies signaling intentions to cut future emissions consistently secured more favorable credit terms (Harris, 2024).