Chief Executive Officers (CEOs) significantly affect their company's profitability, revenue, and investment outcomes. Research indicates that firms experience a decline in performance during a CEO's hospitalization, while their performance remains comparable to peers when the CEO is in good health. Specifically, findings suggest that a 10-day hospital stay can result in a 4% decrease in a company's operating profitability. (Morten Bennedsen, 2020).

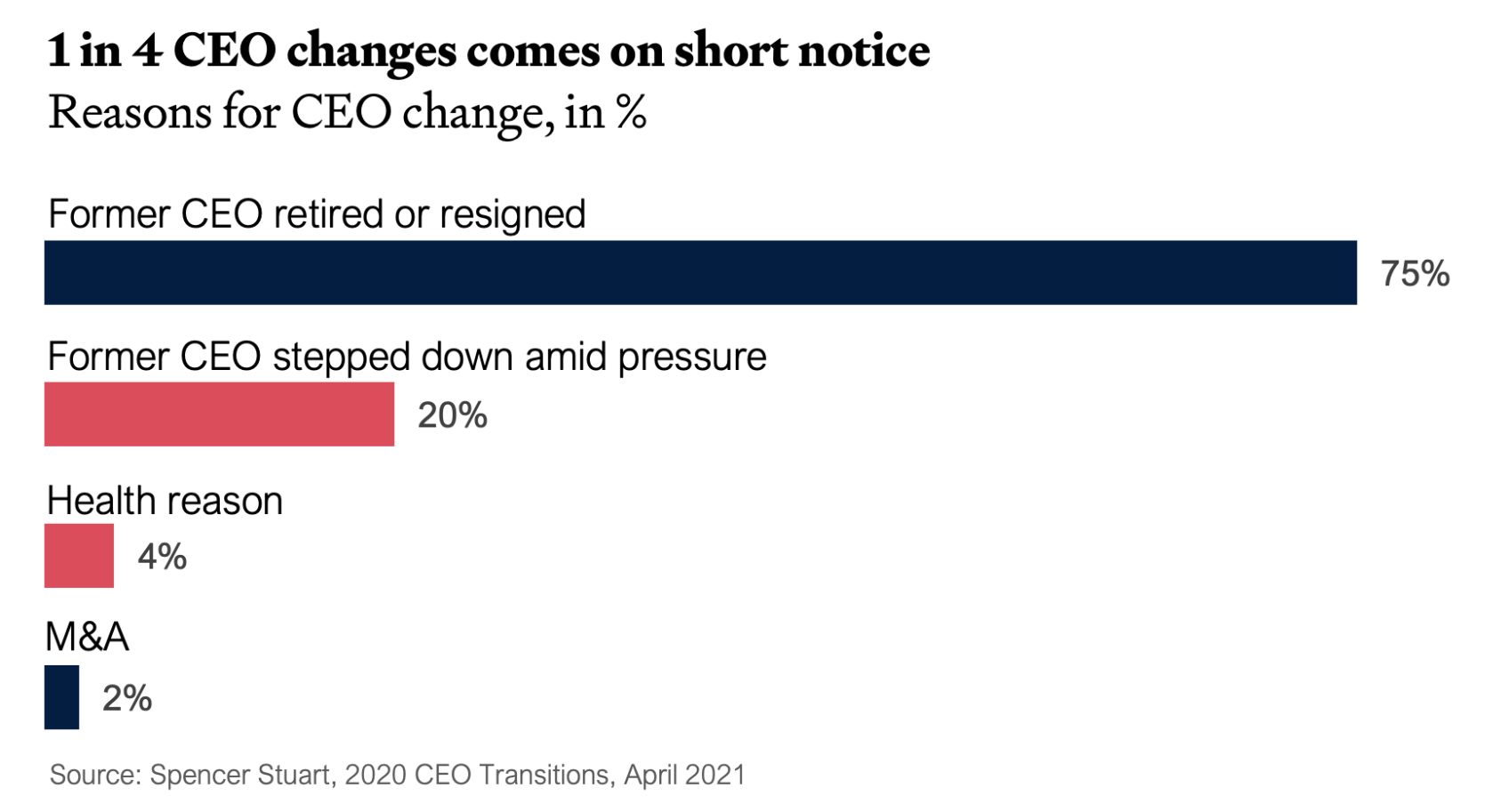

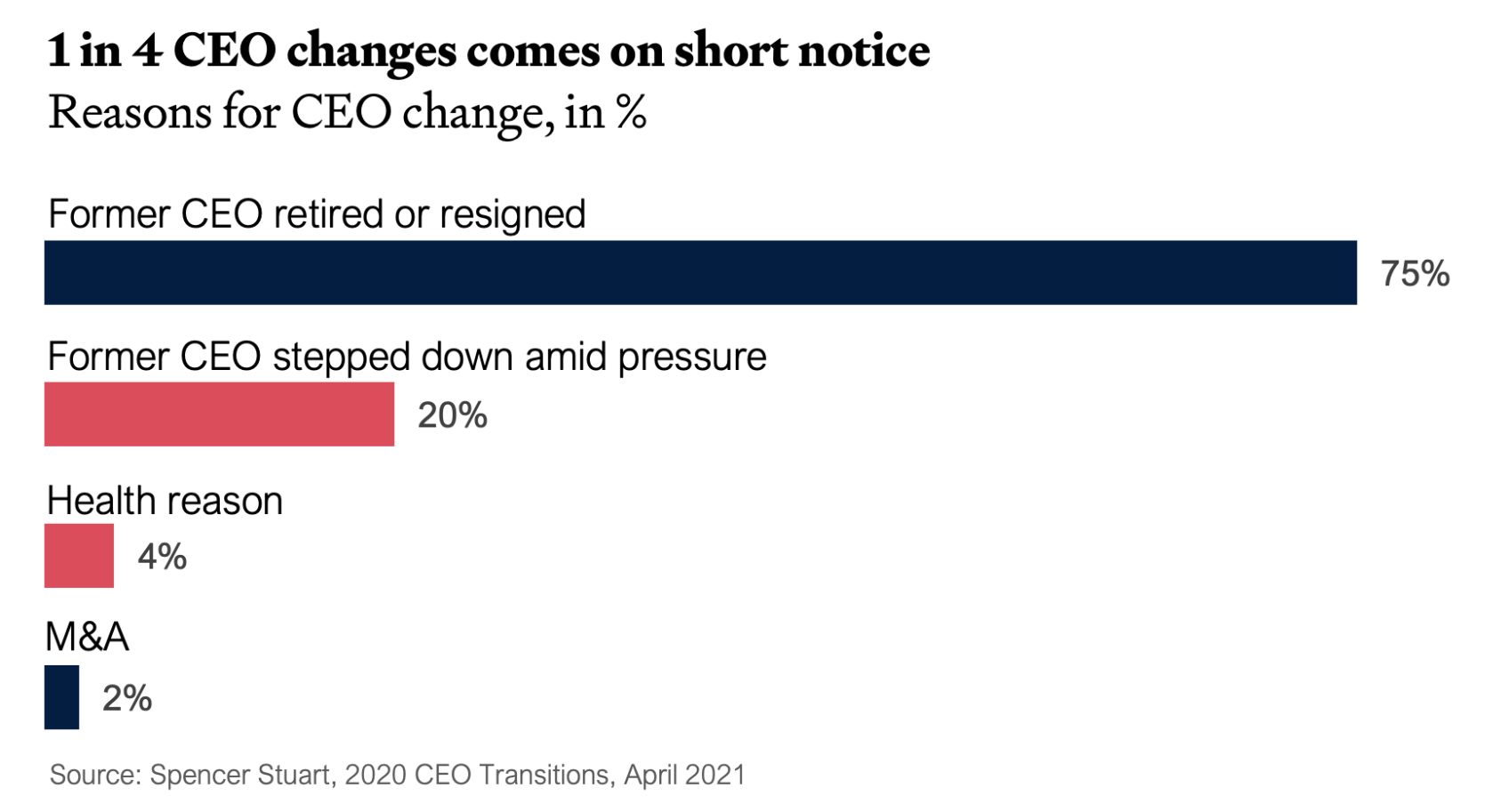

Each year, approximately 10% to 15% of corporations must appoint a new CEO due to retirement, resignation, dismissal, or health-related issues. Given their quintessential and strategic role, understanding, planning, and managing CEO succession and its outcomes is increasingly important. Despite this ongoing need, many boards remain ill-prepared for such transitions. A 2010 survey on 140 CEOs and board directors in Norh America revealed that only 54% of boards were actively developing a specific successor, while 39% indicated they had no viable internal candidates available for immediate replacement of the CEO (Miles, 2010). This gap in preparedness highlights the urgent need for comprehensive succession strategies.

The importance of contingency planning cannot be overstated. Rather than merely reacting to changes, organizations should anticipate challenges and prepare accordingly. This proactive approach offers multiple benefits: it optimizes resource utilization, instills confidence among stakeholders, and minimizes the impact of sudden disruptions. Conversely, reactive measures can lead to resource waste, missed opportunities, and hasty solutions to escalating problems. While the significance of contingency planning is understood, active engagement is essential. This involves allocating funds for unforeseen challenges, dedicating time to develop detailed strategies, training teams, and regularly updating plans to reflect the changing business climate. Ultimately, a well-structured contingency plan empowers businesses to navigate uncertainties effectively, enabling them not just to cope with challenges but to thrive amidst them.

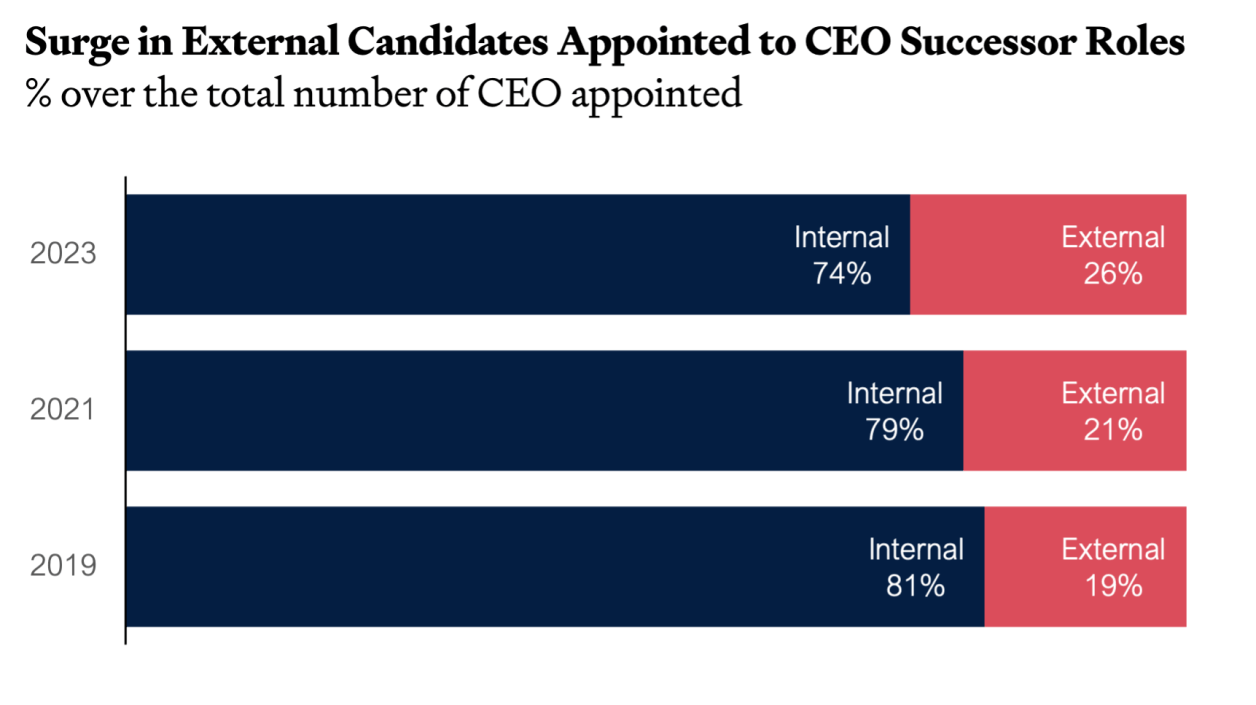

CEO succession often triggers significant organizational change, typically driven by prior underperformance or a strategic intent to enhance growth prospects. The nature of CEO succession significantly influences this process, particularly whether the successor is an insider or an outsider. Insiders, who are familiar with the organization and its competitive landscape, tend to maintain the status quo. They leverage their deep knowledge of firm-specific resources to minimize disruption while adapting to environmental shifts and promoting innovation. This insider knowledge is critical for ensuring a smooth transition during times of change.

In contrast, the rising trend of outsider CEOs—growing from 14% in 2007 to 29% in 2012—often signifies a mandate for change. Outsiders introduce fresh perspectives and possess greater discretion to initiate strategic shifts. They frequently assemble their own executive teams, which strengthens the connection between outside succession and increased strategic transformation. This shift in leadership dynamics highlights the need for organizations to remain agile and responsive to changes in leadership styles and strategic direction.

Building a top-quality senior and middle management team is crucial for successful CEO succession planning and the long-term stability of an organization. By developing a strong pipeline of leaders, firms ensure that potential successors are not only well-prepared but also experienced in handling complex business challenges. Exposing these leaders to key internal and external stakeholders—such as the board, media, investors, and clients—before they step into top roles is essential for their development and credibility. Beyond preparing a pipeline of future leadership, a strong senior and middle management increases resilience to the temporary loss of the CEO.

Tier 1 leaders, who are directly responsible for enterprise-wide operations, and Tier 2 leaders, who manage critical business units or regions, must be equipped with broad, enterprise-level responsibilities. This exposure to P&L oversight, multi-product management, and international operations helps them acquire the expertise necessary to lead at the highest level.

Firms that actively invest in management teams have a strategic advantage, as these leaders are better positioned to drive innovation, handle crises, and ensure smooth transitions. In addition, a robust internal leadership pipeline reduces reliance on external hires and provides continuity during both planned and unexpected leadership transitions, strengthening the organization's resilience and long-term performance (Dan R. Dalton, 2007).

Family firms, often classified as small- to medium-sized enterprises, are vital to economic production, employment, and wealth creation. A key to their success lies in the ability to forge external partnerships, which enhance access to diverse resources and critical information essential for innovation. Research indicates that a higher percentage of non-family members on the board can significantly broaden a family firm’s search for external opportunities, enabling access to various partnerships that support innovation processes. This is particularly important for family firms, as they typically have limited information and resources compared to larger enterprises.

The presence of independent directors can also positively influence research and development investments, counteracting potential drawbacks associated with CEO–chairperson duality. Moreover, the educational level of the CEO plays a crucial role in fostering entrepreneurial behavior and expanding the firm’s engagement with external resources. Overall, building a robust network of external partnerships is essential for family firms to enhance innovation, drive profitability, and ensure long-term growth and resilience in a competitive landscape (Shen, 2021).

Associate

Managing Partner

Dan R. Dalton, C. M. (2007). CEO succession: best practices in a changing. Journal of Business Strategy, 11-13.

Donald J. Schepker, Y. K. (2017). CEO succession, strategic change, and post-succession performance: A meta-analysis. The Leadership Quarterly, 701-720

Miles, D. F. (2010). 2010 Survey on CEO Succession Planning.

Morten Bennedsen, F. P.-G. (2020, March 3rd). Evaluating the Impact of The Boss: Evidence from CEO Hospitalization Events. The Journal of Finance.

Shen, Y. (2021). CEO characteristics: a review of influential publications. Accounting & Finance, 361-385.

SpencerStuart. (2021). CEO Transitions 2020. SpencerStuart.

SpencerStuart. (2024). 2023 CEO Transitions. SpencerStuart.

AI Website Generator