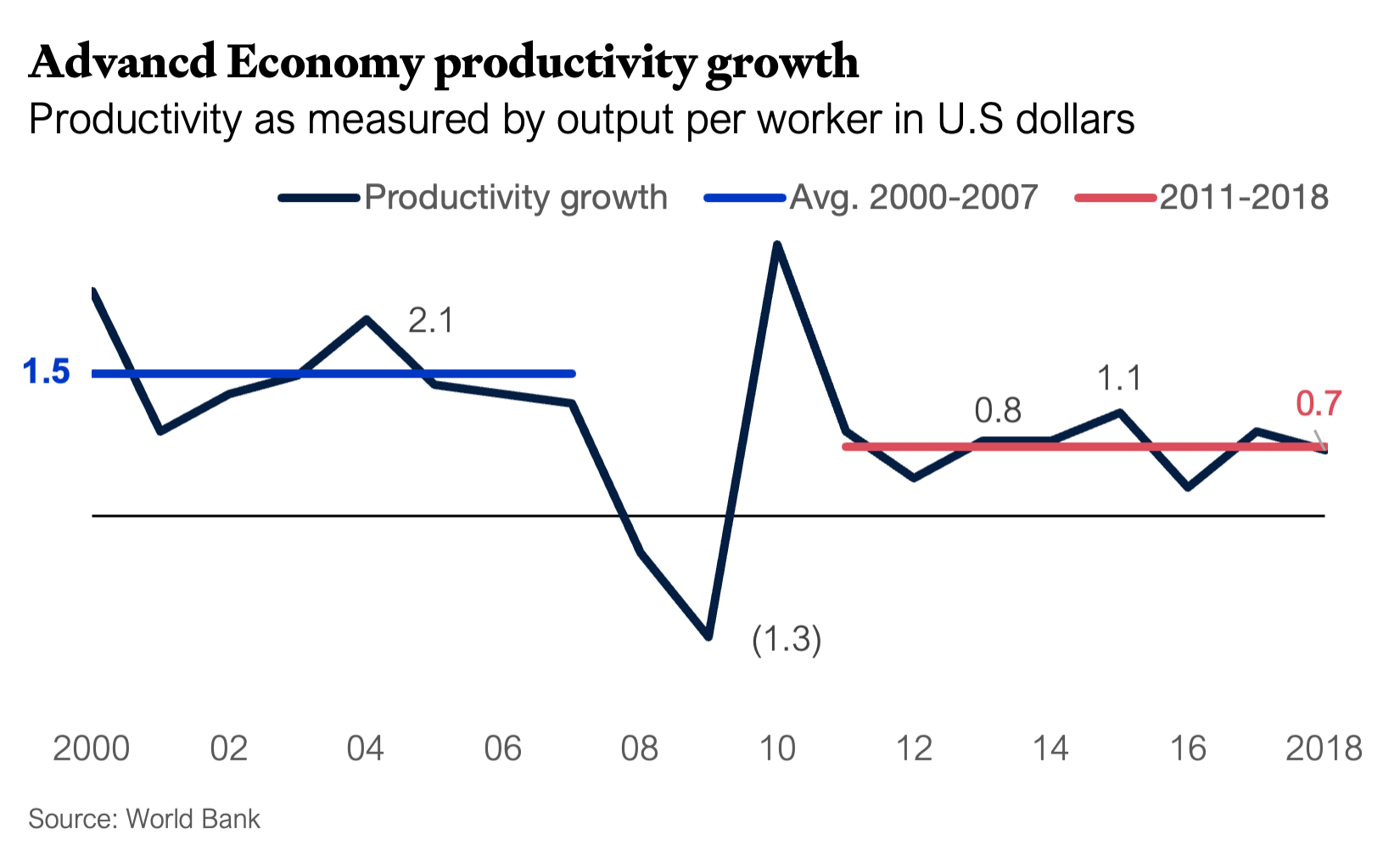

Between 2005 and 2018, average productivity growth in the United States and Europe has been significantly below the long-term average, with productivity in countries like France and the United Kingdom stagnating. This slowdown followed a decade of above-average growth driven by rapid advancements in information technology. Notably, the decline occurred despite an increase in investments aimed at enhancing productivity (Ridder, 2023).

Trends in productivity growth are reflections of a structural change in the way firms produce. In particular, there has been a rise of intangible inputs in companies over the last 30 years i.e. use of software and IT: Software alone is now responsible for 18% of corporate investments, up from 3% in 1980. The rise of intangibles shift costs away from the marginal towards the fix components. This shift is a key reason why investing in R&D is essential, as the uneven adoption of intangible assets encourages innovation among high-intangible firms while creating barriers for others seeking to enter new markets. These firms, motivated by a stronger incentive to invest in R&D, disrupt industries, leading to a disproportionate concentration of economic activity around them. Their entry into the market enhances productivity, as high-intangible firms can produce at lower costs. However, this dynamic ultimately restrains overall growth and welfare, as most start-ups are unable to compete with high intangible incumbents.

Despite these core findings, a 2018 European Investment Bank survey finds that over 40% of European and American manufacturing firms do not use state-of-the-art digital technologies, while less than 15% organize their entire operation around digital technologies. A likely driver is the fact that firms -even within the same industry- differ in the efficiency with which they are able to use intangibles. Additionally, inefficient management practices can explain not only the low IT adoption by firms but also why the productivity gains that these firms obtain from using IT are limited. As most managers know first-hand: If you try to solve a process that is not working with software, you turn an inefficient physical process into an inefficient digital process.

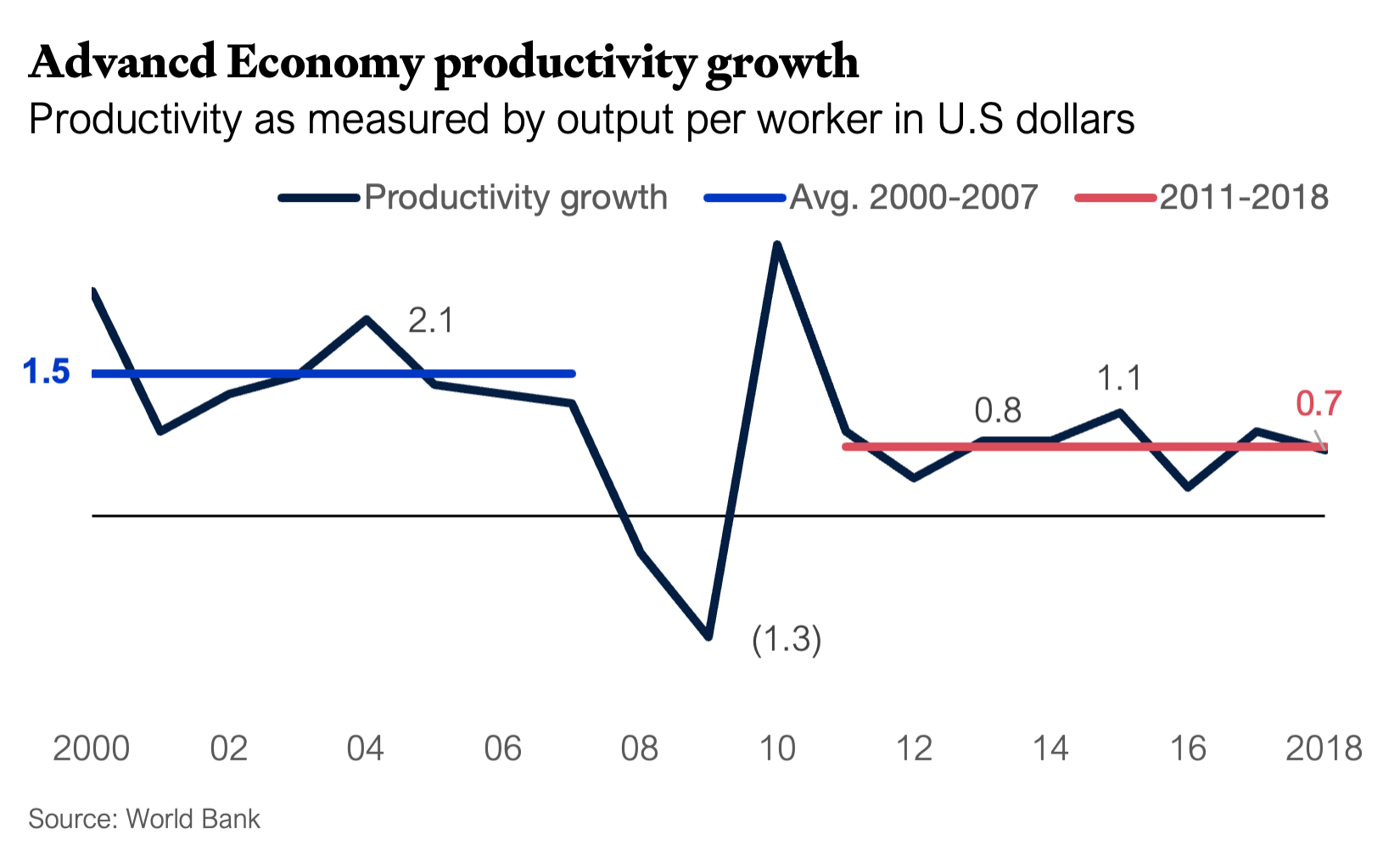

Even if both economies experience a reduction in productivity growth, the gap between European countries and the United States is widening and has now reached considerable size. This divergence aligns, not surprisingly, with a disparity in R&D investment levels, which is thought to be a key factor in explaining the productivity differences. In Europe, the ratio of business R&D spending to GDP was 1.1% in 2002, remained relatively stable until 2008, and saw a modest increase to 1.2% post crisis. In contrast, the U.S. demonstrated higher R&D intensity, rising from 1.7% in 2002 to 1.9% in 2008, before tapering off to return to the same level by 2012.

Some researchers attribute Europe’s lower R&D spending to structural composition effects, noting that the European economy is underrepresented in R&D-intensive manufacturing and service sectors compared to the U.S. Others highlight intrinsic challenges faced by European firms, including general difficulties in investing in R&D and converting those investments into productivity gains. European firms encounter significant challenges in translating R&D efforts into measurable productivity gains, a factor that may also contribute to their lower overall investment in R&D, thereby further widening the gap (Davide Castellani, 2016). Given that R&D investments are crucial drivers of competitive advantage and profitability, companies should reconsider how to translate research improvements into their business models, rather than reducing R&D spending.

Efficient management and organisational practices have been shown to enhance the productivity gains derived from IT adoption. Countries with less efficient management practices have derived fewer benefits from the IT revolution. Additionally, the presence of foreign multinationals and external partnership has proven to significantly improve a country’s management practices. These improvements occur both directly, as subsidiaries adopt the superior management practices of their parent companies, and indirectly, as best practices are disseminated to local firms through mechanisms such as manager mobility. This highlights the critical importance of fostering external partnerships to improve management practices. By leveraging the knowledge and experience of external partners, firms can accelerate their growth, integrate new technologies, and refine their strategic approaches, ultimately leading to stronger market performance and long-term success. Moreover, ownership structure plays a key role, with family-owned firms typically exhibiting weaker management practices compared to those managed by professional managers (Fabiano Schivardi, 2019).

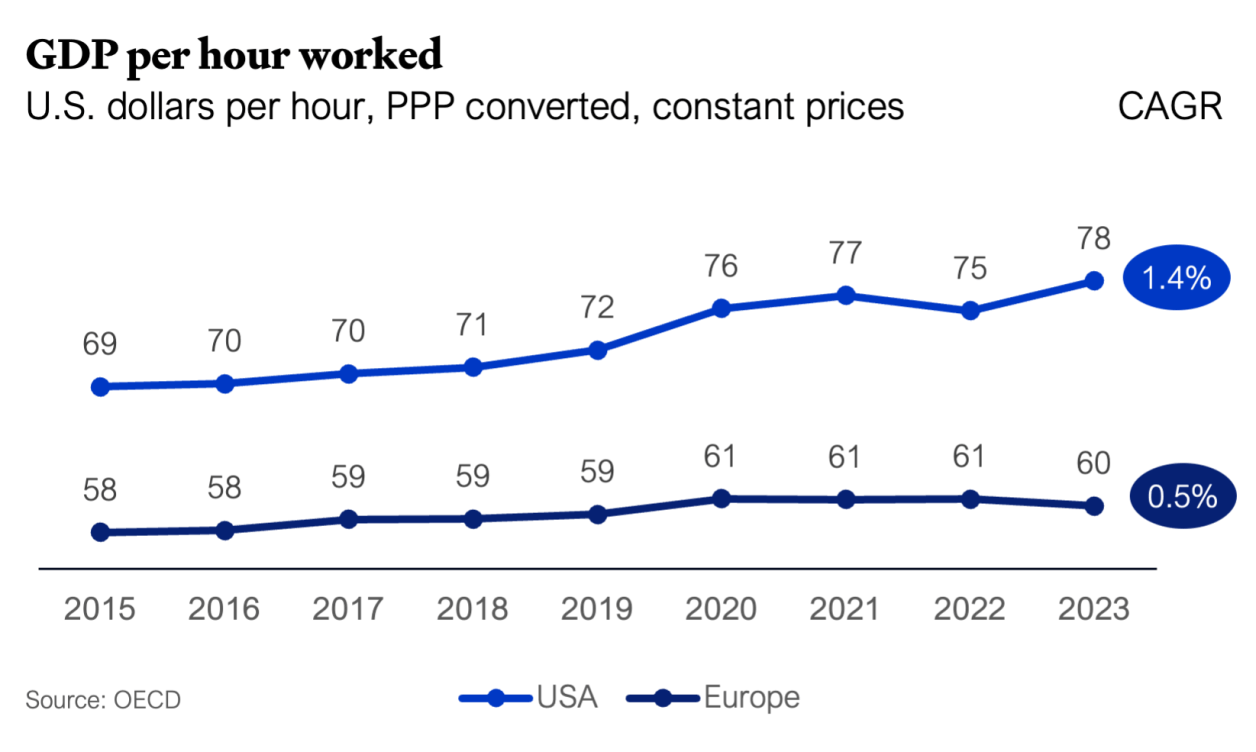

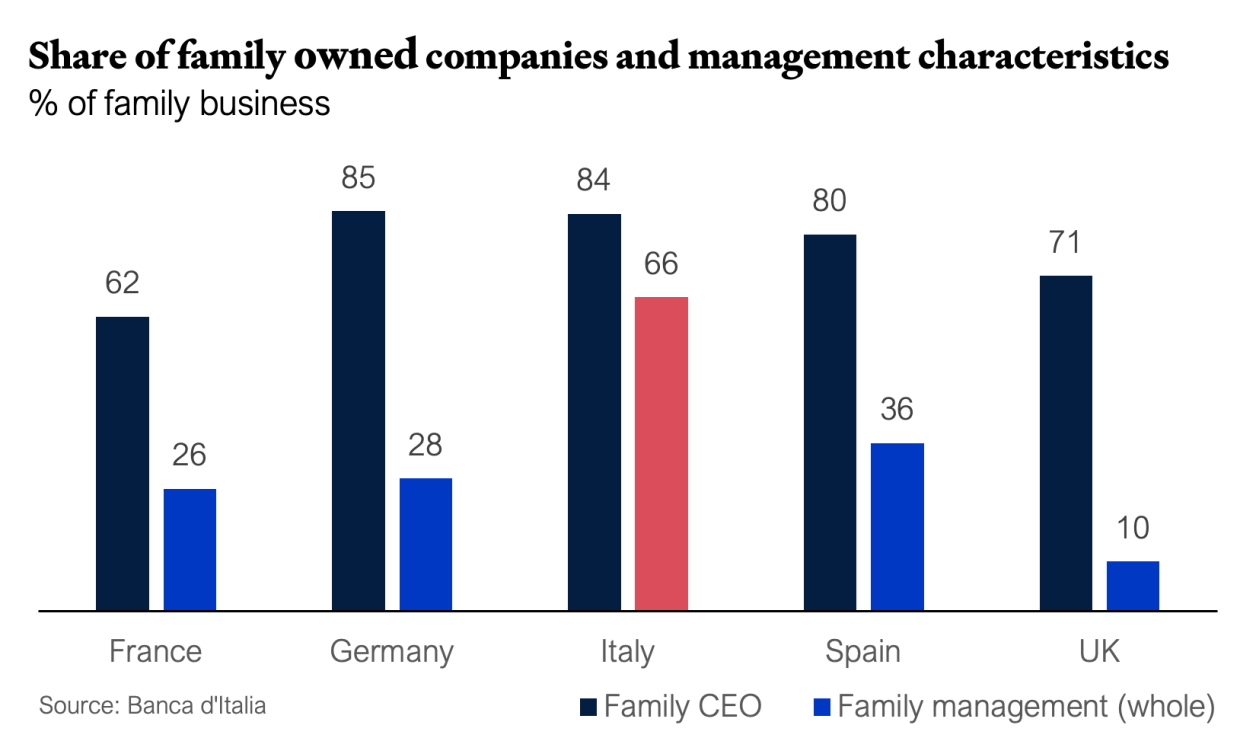

Europe has a notably high proportion of family-owned businesses, e.g. 90% in Germany, to 86% in Italy, and 80% in France. Among family-owned and -managed firms, more than 80% of companies in Italy and Germany have a CEO who is a family member. Italy stands out for its prevalence of family businesses where all management positions are held by family members—representing two-thirds of such firms, compared to one-third in Spain, about a quarter in France and Germany, and just 10% in the United Kingdom (Matteo Bugamelli, 2012).

These characteristics, which are naturally influenced by the smaller average size of firms in Italy, are correlated with innovation tendencies. During the Financial Crisis, Italian non-family-owned firms or those where management is not fully controlled by the owning family demonstrated a 14% higher propensity for R&D compared to strictly family-owned businesses.

It seems plausible that family businesses, on average, exhibit a higher level of risk aversion due to the substantial overlap between family wealth and business assets. This overlap can negatively impact growth, investment, internationalization, and innovation. Family businesses tend to have a lower propensity to engage external management, even when managerial resources within the owning family are limited. While these characteristics are less detrimental during periods of stable and steady economic growth, they can become significant disadvantages in the face of external shocks that demand strong capacities for innovation and renewal.

Companies with decentralized decision-making exhibited even greater differences, with innovation propensities 14%-10% higher, respectively. The gap widened further, reaching 16%-25%, when firms used performance-based compensation for management. These trends, reflecting the relationship between innovation and managerial practices, are consistent across the three major Eurozone economies and can partly explain Europe's lag in innovation.

To wrap up: When discussing “big” concepts like productivity, one tends to forget that an economies’ productivity is determined by how real people working in reral companies have the tools and the environment to do more in less time. To boost productivity, and thus competitiveness, in your company:

Associate

Managing Partner

Davide Castellani, M. P. (2016, May). The Productivity Impact of R&D Investment: A Comparison between the EU and the US. IZA.

Fabiano Schivardi, T. S. (2019). THE IT REVOLUTION AND SOUTHERN EUROPE’S TWO LOST DECADES. Journal of the European Economic Association, 23-33.

Matteo Bugamelli, L. C. (2012). Il gap innovativo del sistema produttivo italiano: radici e possibili rimedi. Rome: Banca d'Italia.

Ridder*, M. D. (2023). Market Power and Innovation in the Intangible Economy. London School of Economics.

Offline Website Builder