The private credit market has tripled in size since 2013, offering an alternative to bank lending for riskier businesses

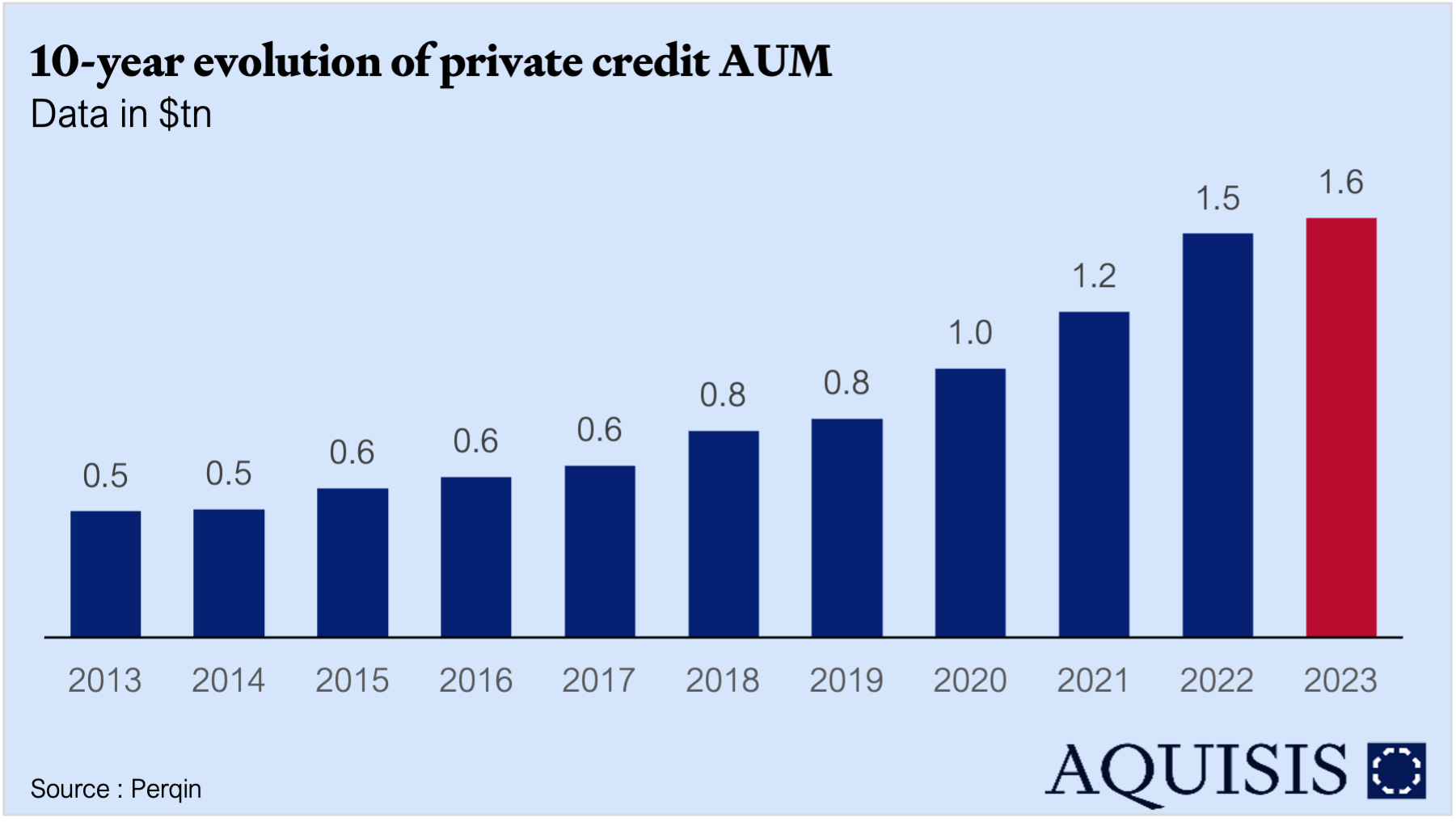

In contrast, investor interest in private debt investment has surged significantly. In July, Ares Management achieved a record-breaking milestone, closing a $34bn private credit fund. The firm announced it had secured $15bn in commitments for its third senior direct lending fund, far exceeding its $10bn target. This success is part of a broader trend of strong capital raising within the private credit sector in recent months, driven by growing investor demand for exposure to the asset class and reaching record-breaking $1.6tn in asset under management in 2023, from just $0.5tn compared to 2013. In October, rival HPS Investment Partners raised $14bn for a new loan fund, with the total reaching $21 billion when factoring in bank leverage. Similarly, Goldman Sachs announced in May that it had surpassed $20 billion for its latest private credit fund (Platt, 2024).

The series of successful capital raises highlights the growing allocation of capital by pensions, endowments, and sovereign wealth funds to new funds. Private credit firms have emerged as dominant players on Wall Street, progressively assuming roles traditionally held by banks since the global financial crisis over a decade ago. In response to higher capital requirements and post-crisis regulatory changes, banks have scaled back from certain business lines and curtailed riskier lending activities. Private investment firms have stepped in to fill this void, becoming key purchasers of bank loan portfolios and playing an expanding role in direct lending to companies.