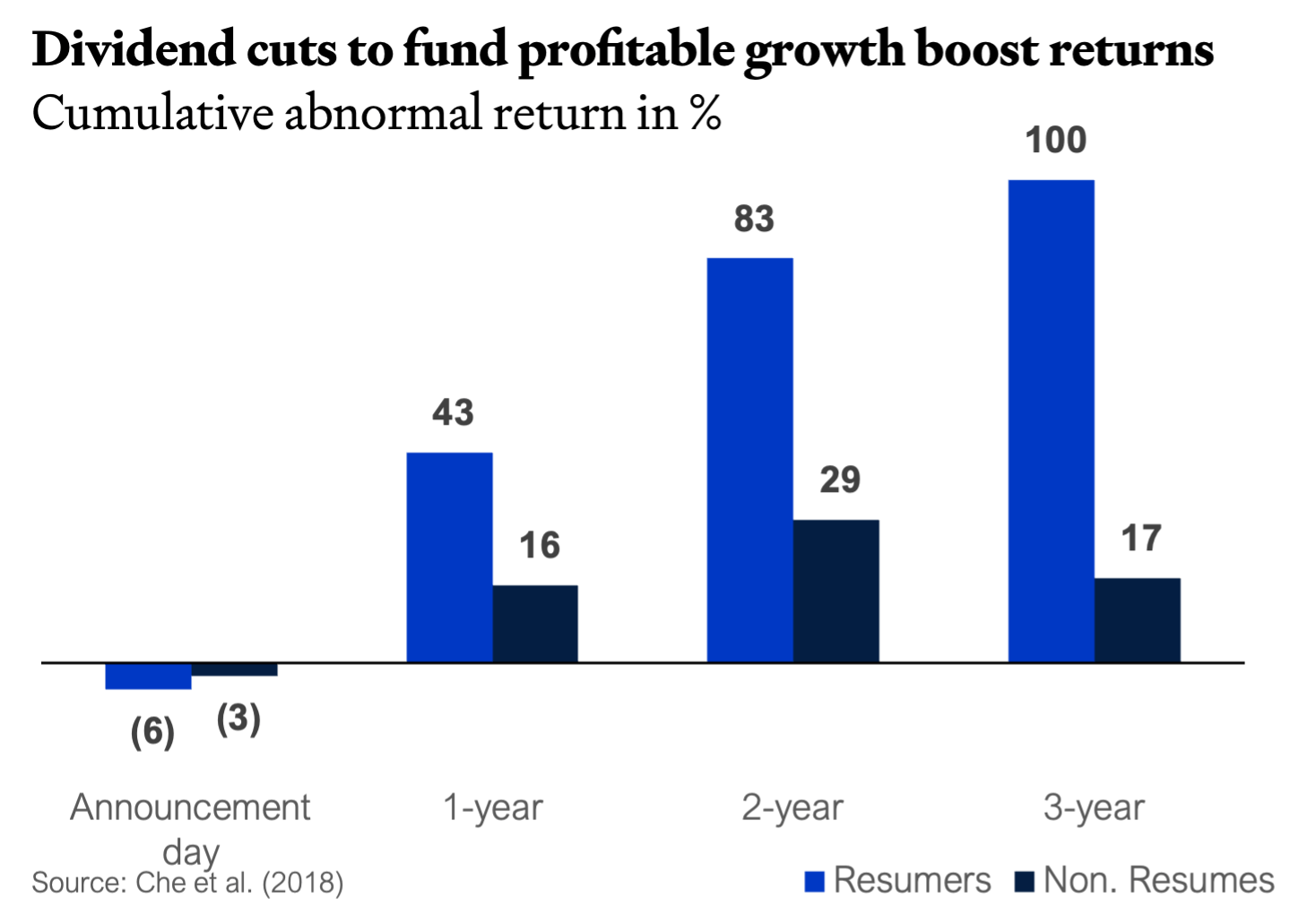

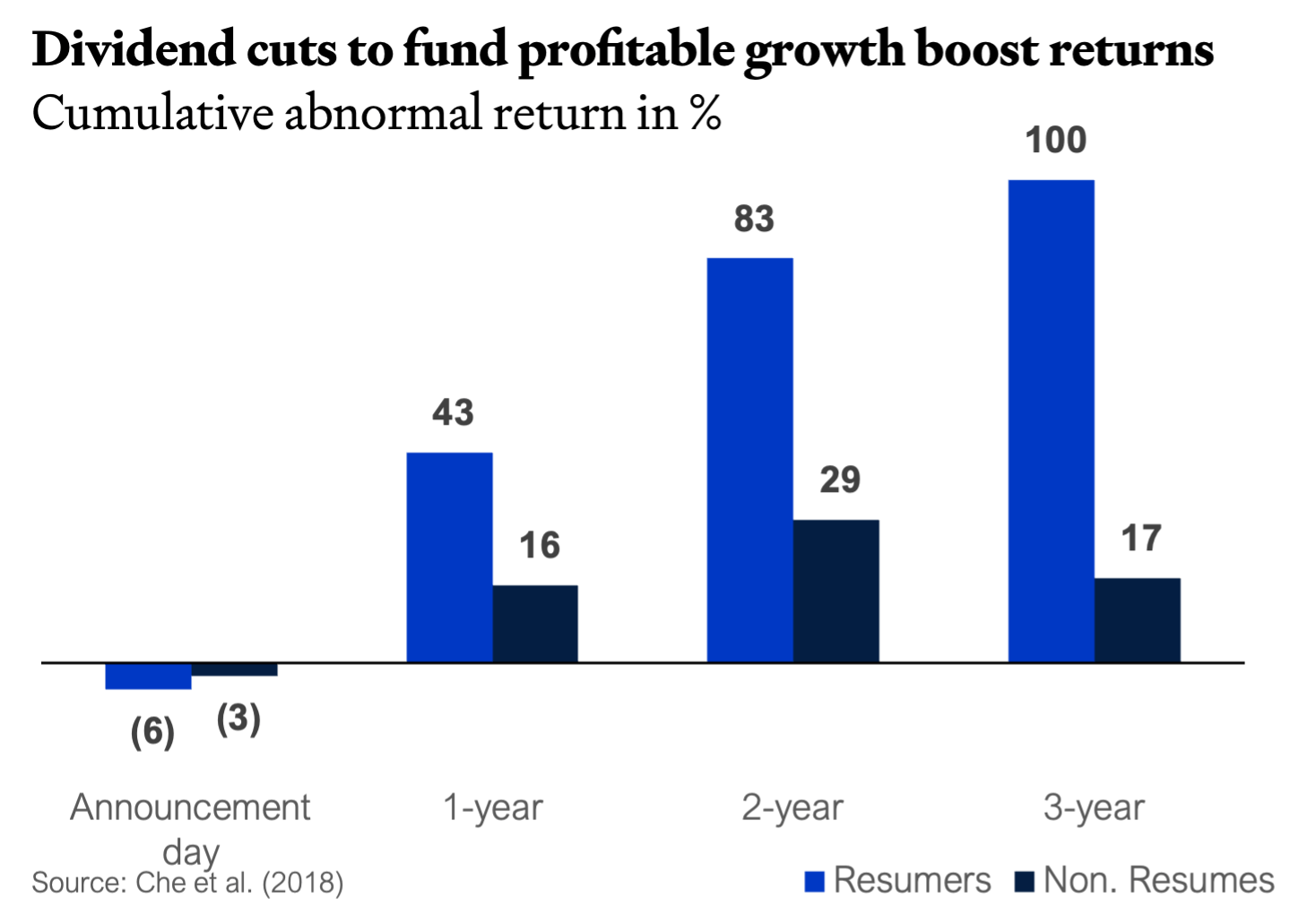

In the face of economic downturns, many businesses instinctively cut costs and scale back on investments. However, this approach limits a company's growth prospects and undermines its long-term success. Instead, focusing on growth opportunities and investing in the company's future can lead to better outcomes. One crucial aspect of keeping a company thriving during a crisis is capitalizing on growth opportunities. Research by Che et al. of University of Mississippi (2018) found that during the 2008 financial crisis, firms with high growth opportunities experienced higher abnormal returns when they cut dividends to invest. Furthermore, these firms were more likely to resume dividend payments within five years and demonstrated significantly higher long-term returns than non-resumers.

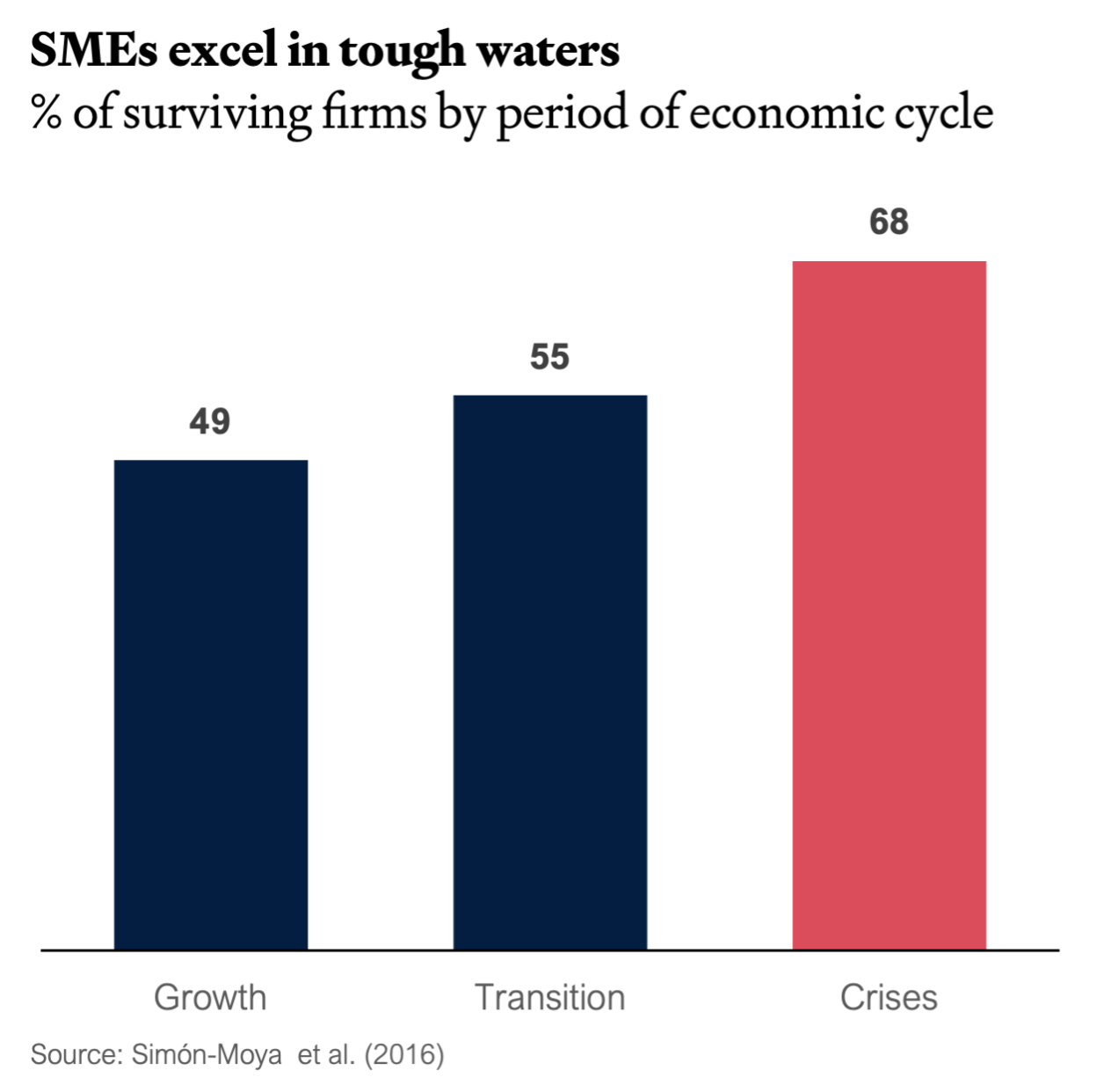

Another, second factor for success during a crisis is fostering an environment that supports new ventures and entrepreneurship. A study by Simón-Moya et al. of Valencia University (2016) discovered that new firms had a higher likelihood of survival during crisis periods compared to growth periods. Variations in the environment expose deficiencies in the market, and thus create opportunities to be exploited. Additionally, the opportunity cost of starting a new business in times of crisis is lower, also due to the scarcity of jobs, entrepreneurs will persevere in keeping their new business in a state of growth.

Adaptability and resilience in the face of adversity not just plant startups’ seed for long-term success, but are also crucial traits in incumbents. Leaders in established companies should encourage the development of new ventures and corporate entrepreneurship during crises, boosting the company's growth once the crisis ends. This requires a (partial) focus shift from cost cutting to creating an environment that supports innovation and creativity, and provides resources and support for entrepreneurs within the company.

CSR, An Anchor in Turbulent Seas

During economic downturns, it is tempting to cut ‘discretionary spending’ like corporate social responsibility (CSR) initiatives. However, maintaining a strong CSR profile can have a positive impact on a company's financial performance precisely during a crisis. Research by Isabelle Ducassy (2013) found a significant positive link between CSR and financial performance during the beginning of the financial crisis. Although the connection between the two variables dissipated as the crisis progressed, investing in CSR initiatives can provide insurance-like protection and improve companies’ financial performance during a financial crisis.

By keeping a focus on growth opportunities, new ventures, and CSR initiatives, companies can not only weather crises but emerge stronger and more resilient. Long-term success depends on continued investment, even during challenging times. This approach can lead to the development of new products and services, entry into new markets, and the establishment of a strong brand reputation.

Attracting the A-Team: The Competitive Advantage of Crisis Investing

Moreover, investing growth opportunities during a crisis can attract top talent and provide a competitive advantage. This commitment to growth fosters a dynamic, innovative workforce that drives company success. Additionally, it promotes an environment of creativity, problem-solving, and collaboration, leading to innovative solutions and strategic partnerships that strengthen your company's market position and growth potential.

In conclusion, during crises, it is vital to adopt a proactive approach by continuing to invest in growth opportunities, fostering new ventures, and maintaining strong CSR initiatives. This strategy leads to higher returns, improved survival rates, and better financial performance across the cycle. By focusing on long-term success rather than short-term cost-cutting, your company can emerge from the crisis stronger and more resilient, with a dynamic workforce, innovative solutions, and a robust brand reputation. Crises are cyclical, and how a company navigates through these challenging times determines its success in good times.

Former Fellow at Aquisis and is a consultant at Modo Sostenibile

Managing Partner

Ducassy, I. (2013). Does Corporate Social Responsibility Pay Off in Times of Crisis? An Alternate Perspective on the Relationship between Financial and Corporate Social Performance . Corporate Social Responsibility and Environmental Management, 20, 157-167.

Virginia Simón-Moya, L. R.-T.-S. (2016). Influence of economic crisis on new SME survival: reality or fiction? Entrepreneurship & Regional Development, 28, 157-176.

Xin Che, A. P. (2018). The effect of growth opportunities on the market reaction to dividend cuts: evidence from the 2008 financial crisis. Review of Quantitative Finance and Accounting, 51, 1-17.

HTML Website Builder