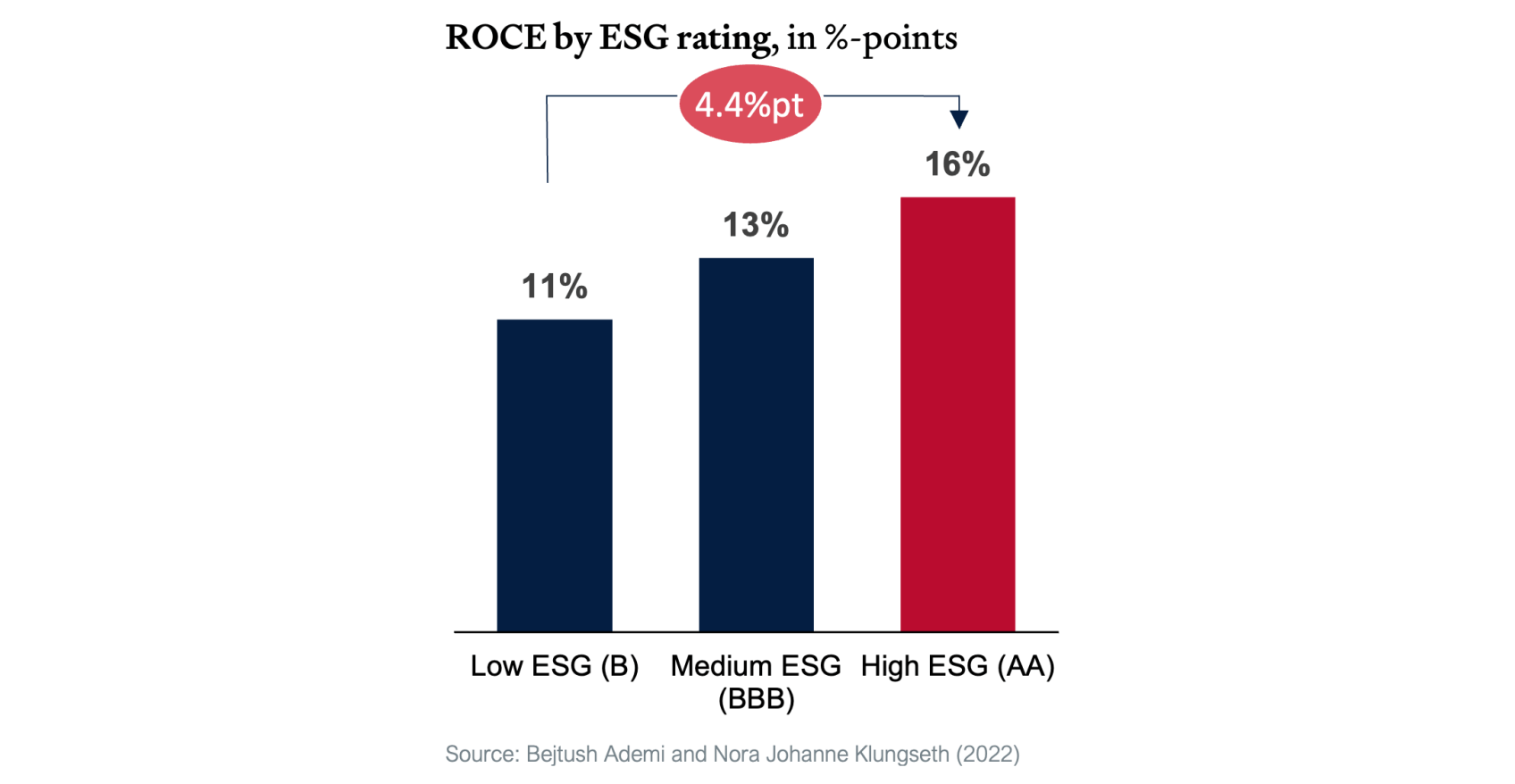

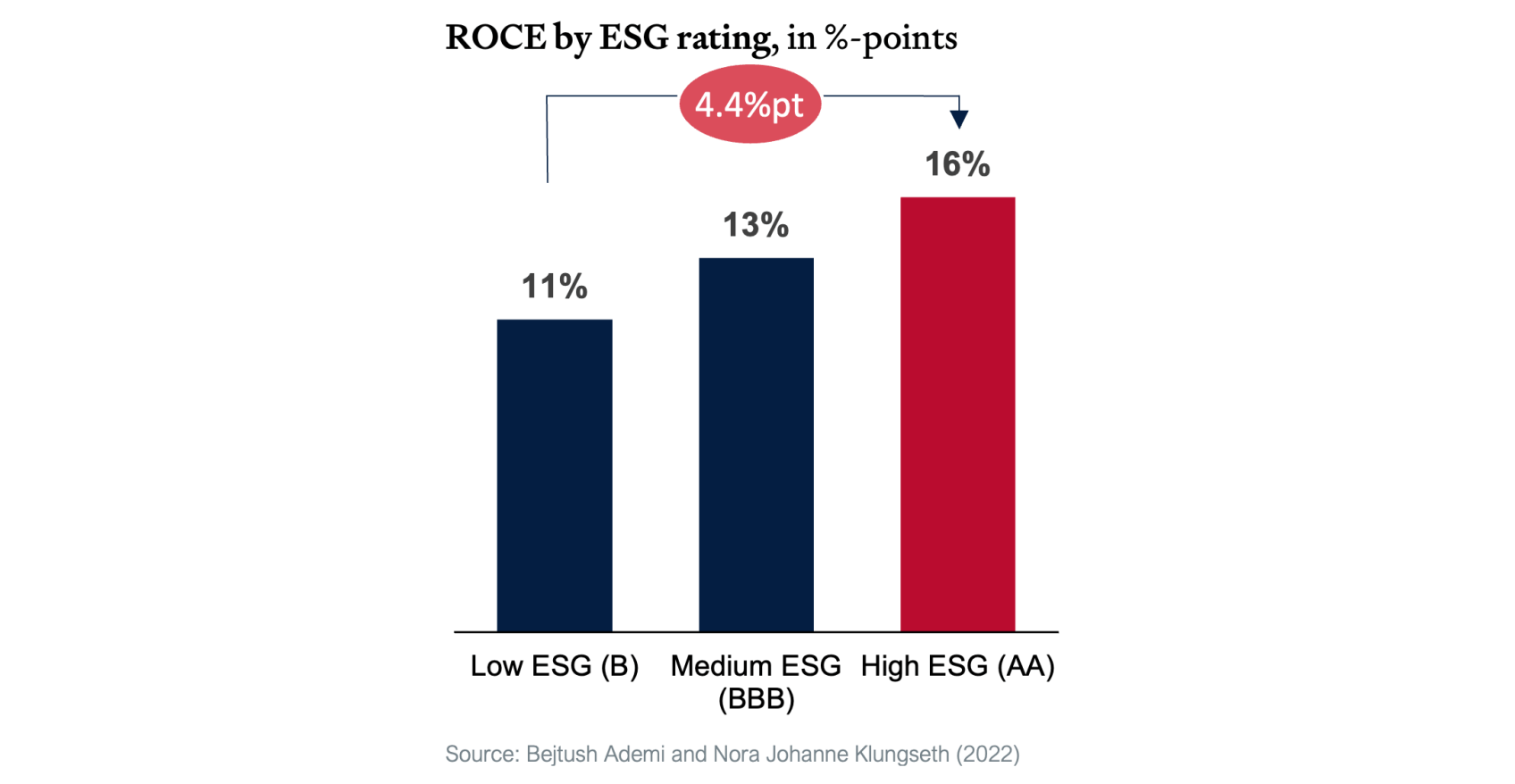

Owners have strong reasons to prioritize effective ESG practices: superior ESG performance drives company value. Research by Bejtush Ademi and Nora Johanne Klungseth reveals a significant positive correlation between ESG initiatives and company value. By examining 150 S&P 500 companies over the period from 2017 to 2020, the study assessed value creation retrospectively through financial performance and prospectively in terms of market valuation. This timeframe captures both the pre-COVID era and the onset of the pandemic, a period marked by extraordinary economic uncertainty. Findings indicate that robust ESG performance not only drives value but does so resiliently, even amid crises.

Superior ESG practices can boost financial performance in several ways. Firstly, strong ESG performance mitigates risks, which is beneficial for future cash flow. Secondly, a higher ESG rating facilitates access to lower-interest debt, thereby reducing the cost of capital—an especially pertinent consideration in the current banking climate. An improvement of one MSCI rating grade in ESG correlates with an increase of 1.1%-points in return on capital employed.

Market valuation improvement due to superior ESG can be explained by several factors. First, better ESG can lead to better quality of a company’s product and better reputation of a company. Secondly, superior ESG contributes to mitigating systematic risk, regulatory risk, supply chain risk, technology risk and litigation risk, all of which are valued by investors (Bejtush Ademi, 2022). As green investments are becoming more and more popular, companies with better ESG rating are more likely to attract both institutional and individual investors. In fact, one of our clients became so attractive to ESG-focused investors that their valuation decoupled from their financial performance, staying higher than peers’ even when margins collapsed.

Additionally, Superior ESG performance supports a company’s value creation also and especially during an unexpected crisis. It is mainly due to trust built with stakeholders but also with investors. Companies with better ESG face less elastic demand in turbulent time in comparison to the industry peers.

When enhancing a company’s ESG for value creation, it is important to recognize the limitations of ESG ratings. Various methods exist for calculating ESG performance, with only a few recognized indices, which complicates comparisons across companies. This lack of standardization can lead to inconsistencies and confusion among potential investors. Furthermore, ESG indices attempt to quantify aspects that are inherently difficult to measure, and studies on ESG’s impact on financial performance have shown mixed results

ESG score providers aggregate data of varying quality from diverse sources into composite scores, often weighted by sector relevance. For example, carbon emissions account for 19% of scores for oil and gas companies. Scoring inconsistencies remain: different providers frequently rate companies with only 60% correlation, unlike credit ratings, which can reach 99% consistency across agencies like Moody's and S&P. Nevertheless, ESG remains a valuable metric, offering critical insights and influencing financial outcomes (Josek, 2024).

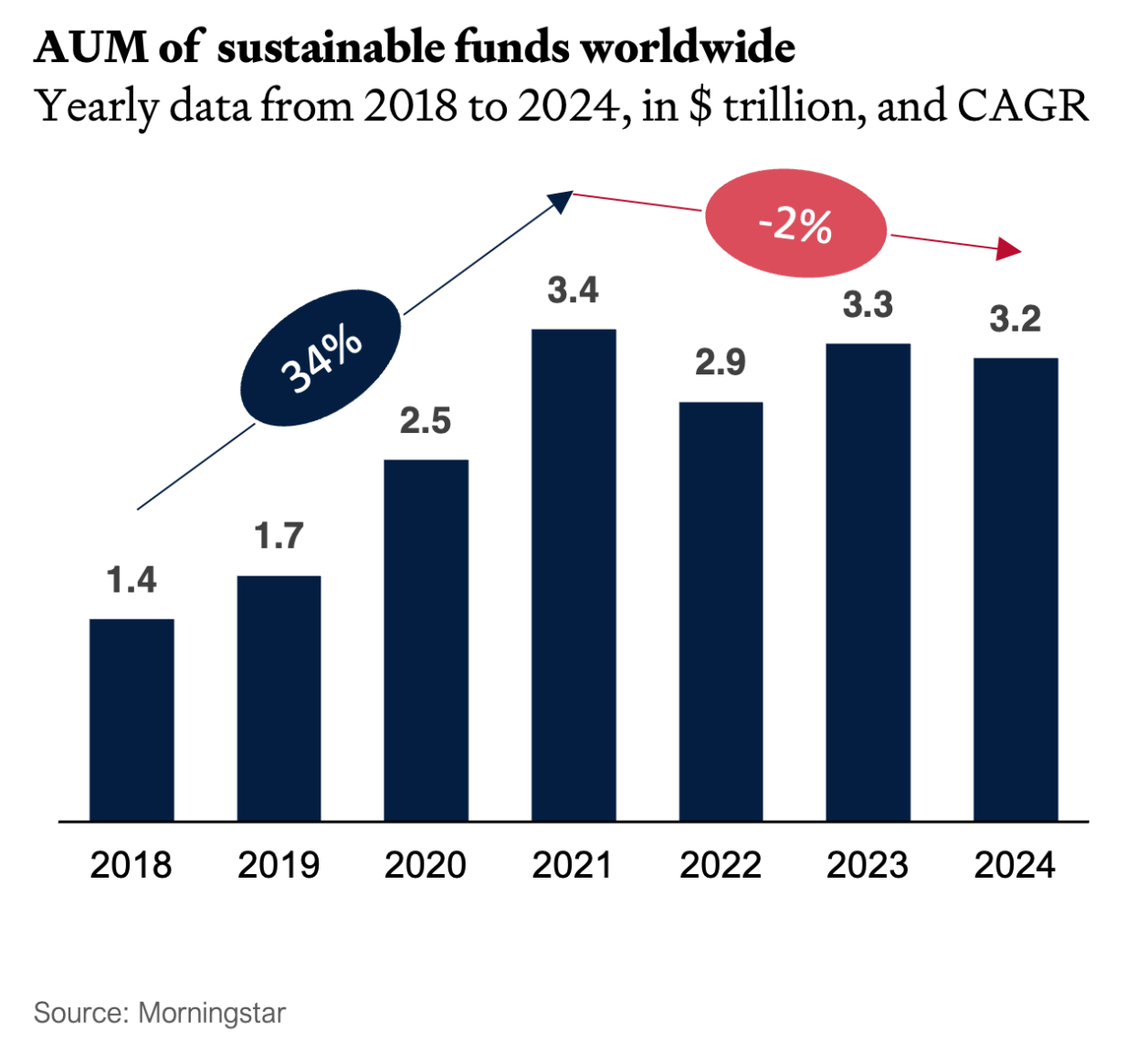

Barclays reports that $40 billion has been withdrawn from ESG equity funds this year, prompting questions about the future of ESG investments. Despite recent outflows, ESG-focused equity funds and ETFs still command a substantial $1.9 trillion globally—roughly 7% of all equity assets, according to Morningstar. These withdrawals appear more reflective of relative financial performance than waning confidence in ESG’s impact. For instance, the Nasdaq has outperformed the MSCI ESG Leaders Index by approximately 50% over the past two years ( ESG funds — how to play a diffuse category, 2024).

Enthusiasm for ESG initiatives among asset managers also seems notably lower. In 2021, firms like BlackRock and Vanguard supported over 46% of environmental and social (E&S) proposals, driving record-high support, with overall backing reaching 33%. Yet by 2024, this momentum has slowed significantly: BlackRock supported only 4% of E&S proposals, while Vanguard opposed all, resulting in just 13 resolutions passing, down from 64 in 2022. Critics suggest this pullback could signal either an initial lack of commitment or a response to conservative backlash against “woke capitalism” and ESG-focused investing (Masters, 2024).

A more pragmatic view suggests that the ESG movement may simply be facing tougher challenges, having already achieved many of the “low-hanging fruit.” Initial ESG-driven reforms were broadly supported by both profit-driven investors and environmental advocates, as measures like managing climate risk and reducing waste aligned with both sustainability goals and financial returns. Now, achieving further ESG progress may require more complex and costly shifts, demanding deeper commitment from companies and investors alike.

Associate

Managing Partner

ESG funds — how to play a diffuse category. (2024, June 15). Financial Times.

Bejtush Ademi, N. J. (2022). Doesit pay to deliver superior ESG performance? Evidence from US S&P 500 companies. Journal of Global Responsibility, 421-449.

Gifford, E. J. (2010). Effective Shareholder Engagement: The Factors that Contribute Shareholder Salience. Journal of Business Ethics, 79-97.

Josek, P. D. (2024, January 24). What is the point of ESG ratings? Financial Times.

Masters, B. (2024, September 7). The way forward for ESG. Financial Times.

No Code Website Builder